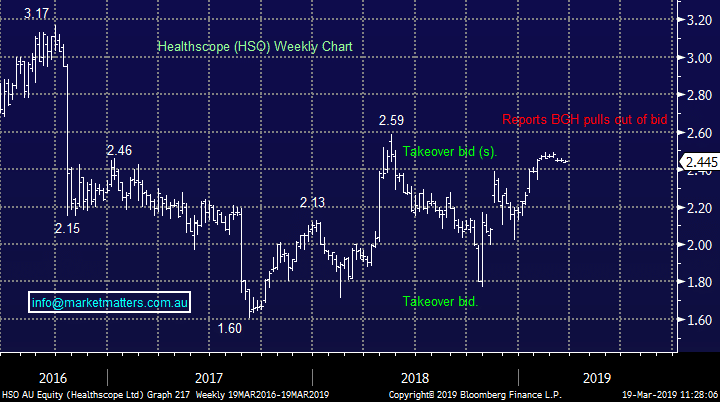

Healthscope (HSO) Takeover: Should you cash in?

Stock

Healthscope (HSO) $2.44 as at 19/03/2019

Event

Plenty of shares being traded in the hospital operator over the past few sessions as reports that one of their two suitors has dropped out of the tussle.

To recap, private equity firms BGH capital and Brookfield have been in a standoff over Healthscope for almost a year now, with the latest offer from Brookfield under a scheme of arrangement at $2.50/share (or off-market acquisition at $2.40) being unanimously recommended by the board last month.

While BGH is still ‘ at the table’ rumours are circling that they’ve advised their banking syndicate to stop work on the deal, unable to see value in offering a higher bid.

So it appears the bidding war has come to an end, and we expect to see HSO taken from the ASX boards by Brookfield soon. The only thing in their way now appears to be the BGH consortiums ~19% stake in the company. Unlikely to be a big enough holding to block the takeover – and unlikely that the consortium would not vote for the offer now that they are out of the race and would be looking to sell down in any case.

A scheme meeting to vote on the Brookfield bid is expected to be held in May / June this year. The transaction will play out in one of 2 ways. 1) a Scheme of Arrangement valued at $2.50/share ($2.465 + $0.035 interim dividend) which requires 75% shareholder approval or 2) a simultaneous Takeover

Offer valued at $2.40/share ($2.365 + $0.035 div) which requires only 50.1% shareholder approval.

Healthscope (HSO) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook