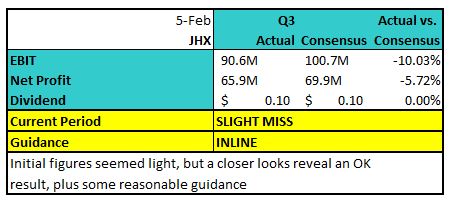

James Hardie (ASX: JHX) holds up in a tough 3rd quarter environment

Stock

James Hardie (ASX: JHX) $15.80 as at 5/02/2019

Event

James Hardie’s 3rd quarter result was closely watched this morning following the downgrade by peer Boral (ASX: BLD) yesterday. So far the market has liked the release, with the share price for James Hardie trading up +4.5%, but going as high as 6.5%, to trade over $16 earlier in the day.

The construction material company’s result was slightly below the same quarter of last year, but it showed the company performing well while the US housing market struggled.

The market was not asking much at this result, trading on around 14x PE, the cheapest level in almost a decade and the numbers did enough to impress.

Guidance for the full year was in line with expectations, with management guiding to $US295m to $US315m vs the market at $US306m for the March year end. Perhaps investors were just pleased it didn’t follow Boral’s lead.

The company did note an accelerating squeeze in margins, which fell 3.5% points over the quarter. This was driven by input costs however it continues to experience above market growth rates across its segments, with price increases helping to offset some of the added costs.

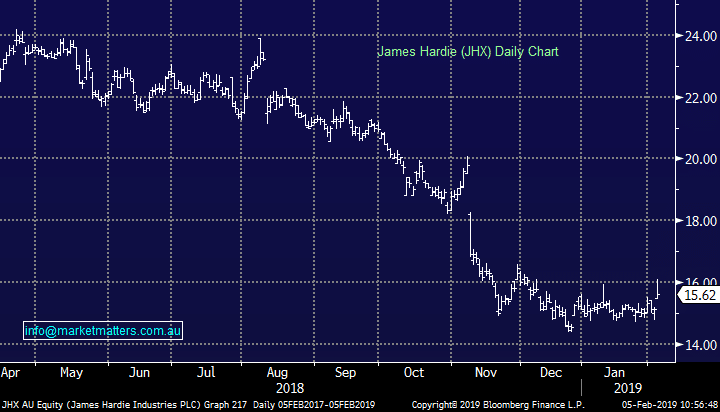

James Hardie (ASX: JHX) Chart

The market was not asking much at this result, trading on around 14x PE, the cheapest level in almost a decade and the numbers did enough to impress.

Guidance for the full year was in line with expectations, with management guiding to $US295m to $US315m vs the market at $US306m for the March year end. Perhaps investors were just pleased it didn’t follow Boral’s lead.

The company did note an accelerating squeeze in margins, which fell 3.5% points over the quarter. This was driven by input costs however it continues to experience above market growth rates across its segments, with price increases helping to offset some of the added costs.

James Hardie (ASX: JHX) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook