Fletcher Building (ASX: FBU) is falling on poor guidance

Stock

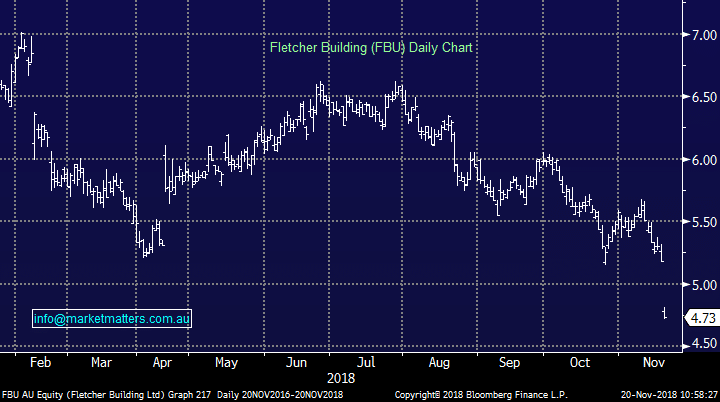

Fletcher Building (ASX: FBU) $4.73 as at 20/11/2018

Event

The building materials manufacturer (ASX: FBU) is the worst performing company on the index in this morning’s trade.

The company released disappointing FY19 guidance before the market opened, continuing the recent weak commentary coming from a number of construction leveraged names.

Guidance for full year EBIT (before one off charges) was $630m - $680m, with the top end below the consensus estimate of $692m.

The commentary provided by the company focussed on a weak housing outlook in both New Zealand & Australia – the company’s main markets.

In the Australian residential market, the biggest contributor to the company’s result, trading conditions have come under pressure as input prices rise and the housing market cools squeezing margins and volumes.

Today’s poor guidance from Fletcher follows a number of construction & real estate companies giving soft commentary around the currently soft market conditions.

LendLease (ASX: LLC) took a huge hit to their engineering business recently, citing input costs, delays and productivity as reasons for the $350m impairment.

Similarly, Boral (ASX: BLD) was extremely downbeat in their recent commentary and the market hasn’t reacted kindly.

Fletcher Building (ASX: FBU) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook