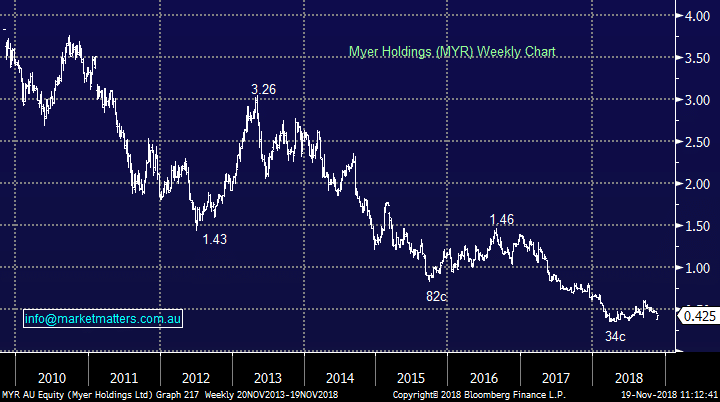

Why Myer Holdings Ltd (ASX: MYR) is crashing

Stock

Myer Holdings (ASX: MYR) $0.42 as at 19/11/2018Event

The Myer Holdings Ltd (ASX: MYR) share price is taking a hit this morning as shares in the embattled department store resumed trading after its trading halt on Friday. The stock tumbled over 11% to a five-month low of 40 cents when management was forced to release its September quarter sales results. In contrast, the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) index slipped 0.4% in early Monday trade following renewed fears of a US-China trade war after the frosty APEC meeting. Myer was forced to release its sales result in response to media speculation that Myer’s 1QFY19 sales had crashed a further 5.5%. Things aren’t quite as bad as that with management stating that sales for the period declined 4.8% over the previous corresponding period, or 4.3% on a comparable store basis (which measures sales performance of outlets opened for a year or more). However, that won’t be enough to quell the sceptics and is likely to give more ammunition to critics like Premier Investments Limited’s (ASX: PMV) chairman, Solomon Lew, who is agitating for a board spill. Myer isn’t the only retailer under earnings pressure. Even highly regarded listed retailers like Kogan.com Ltd (ASX: KGN) and Lovisa Holdings Ltd (ASX: LOV) have issued disappointing updates recently. Meanwhile, shareholders in Reject Shop Ltd (ASX: TRS) are licking their wounds after a series of profit downgrades that shaved-off more than 70% of Reject Shop’s share price since April this year. The profit warnings raise questions about the sector ahead of the all-important Christmas trading period where retailers make most of their yearly profits. But the dark shadow isn’t confined to Australia. US department store Nordstrom, Inc. spooked investors on Friday by reporting lacklustre sales and falling profits. It seems no one is paying full-price in the US either and discounted products are squeezing margins as brick-and-mortar stores try to fight off the online shopping threat that’s epitomised by the likes of Amazon.com, Inc. The profit shock from Nordstrom followed poor sales updates from fellow-department stores Macy's Inc and Dillard's, Inc. earlier in the week. But a big de-rating can spell opportunities in some cases. The ASX banking sector is another that’s cast into the sin-bin with the Westpac Banking Corp (ASX: WBC) share price and the National Australia Bank Ltd. (ASX: NAB) share price trading around a 52-week low. Should you be buying the dip in Myer? Myer Holdings (ASX: MYR) Chart