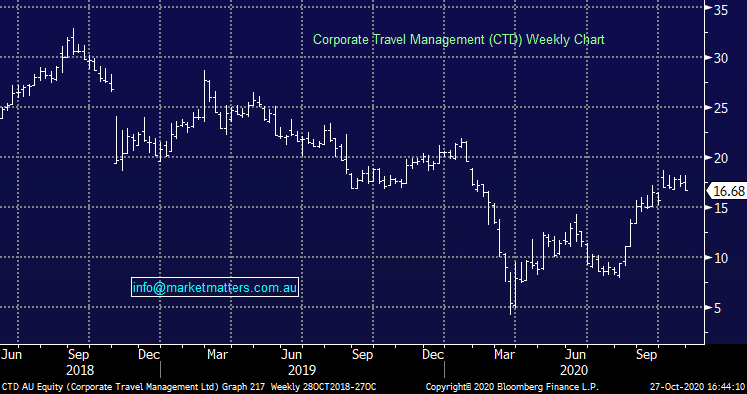

Corporate Travel (CTD) falls on first quarter

Corporate Travel (CTD) -7.33%

Travel stocks were broadly weaker today with the market, though CTD fell more than peers on the day it hosted it’s AGM. The company note it had recorded an EBITDA loss of $1.6m and $3.5m cash burn for the month of September, with $120m net cash it looks well placed to ride the pandemic out. Those numbers were a bit light on to what was being hoped, and while earnings this year are arguably irrelevant the market wasn’t too keen on it. Revenue for the quarter was just $28.8m, and even though there is no doubt CTD will skew income to the second half there is a big gap to close to hit the expected numbers.

Corporate Travel has been aggressive of late, buying US based agent T&T and raising a considerable amount of money to do so. The deal closes in just a few days and will be the company’s next major task. The market has been using travel stocks as a vaccine proxy, and they looked pretty fully valued as a result.

Corporate Travel (CTD) Chart