CSL rallies on better plasma collections

CSL Limited (CSL) +6.4%

Delivered an inline result plus guided to profit for FY21 of $2.1bn-$2.26bn which implies only small growth on the $2.11bn delivered in FY20 + was a ~5% miss to current market consensus, yet the stock still put on +6.4% - why? The market was concerned about plasma collections during lockdowns however CSL spoke to that on the conference call saying collections were down 20-30%, not the 60-70% some were expecting + they talked up higher inventory levels. They also said that collections had bounced back strongly since then and that’s the key to today’s performance. Also helping is the expectation that CSL will produce the locally manufactured COVID-19 vaccine (when it comes) and of course, they’re one of very few companies that have provided concrete guidance, although it was a miss, it still shows a degree of confidence.

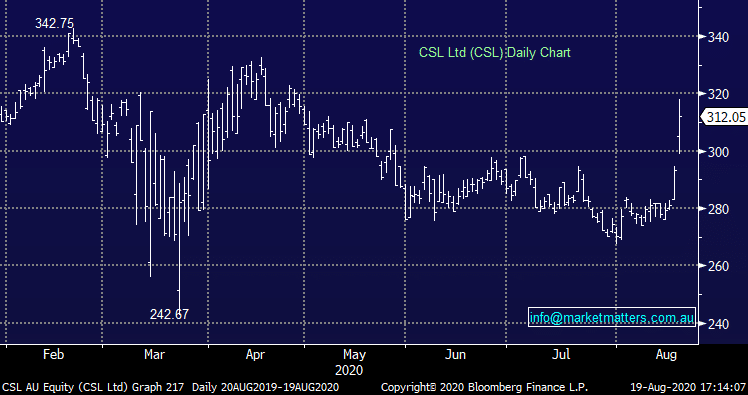

CSL Limited (CSL) Chart