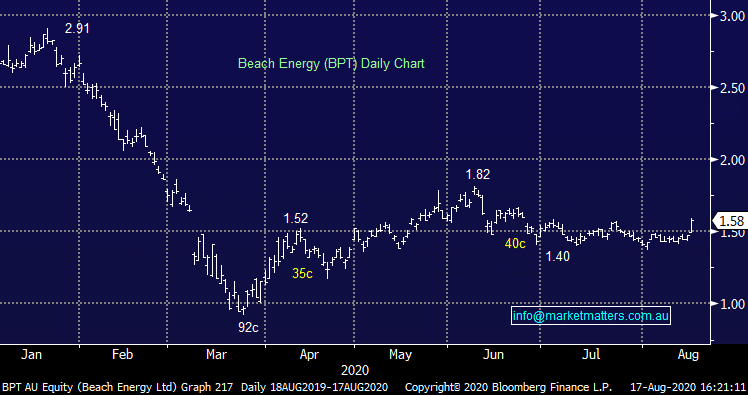

Beach Energy (BPT) control costs to beat expectations

Beach Energy (BPT) +7.12%

A strong FY20 result from BPT today with our medium-term thesis for owning intact. We’ve got a new energy analyst at Shaw (Michael Clark) and today BPT beat his expectations reporting underlying NPAT of $461m v his expectations for $442m. Operating cash flow of $874m is down 15% on FY19 due to realised pricing effects but ahead of estimates – that weaker operating cash flow fed into slightly decreased net cash of A$50m (from A$60m 1H20). Guidance has been released for FY21 for the first time and is broadly in line with consensus estimates. They also provided an update to their 5-year outlook (post COVID-19) - it’s more conservative in the short term (reflecting a COVID-19 response), however in line with long term estimates for production and capex.

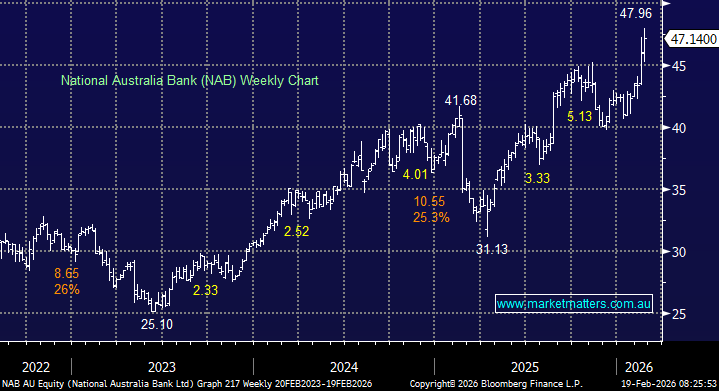

Beach Energy (BPT) Chart