Centuria Industrial (CIP) to buy Telstra data centre

Centuria Industrial REIT (CIP)

Didn’t trade today as it looks to raise $340m to fund three acquisitions, the largest of which is a $416.7m purchase of a Telstra data centre in Victoria on a cap rate of 4.25%. The deal is significant, with the asset to make up ~20% of the total asset value in the trust. The purchase comes with a lease back agreement, on a triple net lease of 30 years with an option to extend for Telstra. The site is near to the telcos main operations site, and remains key to their service while Centuria were talking up their new partnership with Telstra, providing an opportunity to offer more space across the portfolio. CIP also acquired two smaller assets – a $16.4m industrial facility in NSW and a $14m distribution centre in the outskirts of Melbourne. The raise at $3.15/share is a 4.8% discount to last close, a tight margin but it also represents a 11.7% premium to NTA.

Alongside the raise, CIP announced their full year result with FFO per unit at 18.9c and distributions of 18.7c for the year in line with guidance, albeit at the lower end. The book is currently 97.8% occupied with WALE of 7.2yrs and geared at 27.2%. Rent collections for the hairy last quarter came in at 97% with nearly all tenants operating through the period. Valuation for the portfolio grew in the period despite the headwinds to asset values. CIP guided to 17.4c FFO per unit for the year ahead and 17c to be distributed representing a 5.1% yield on last close.

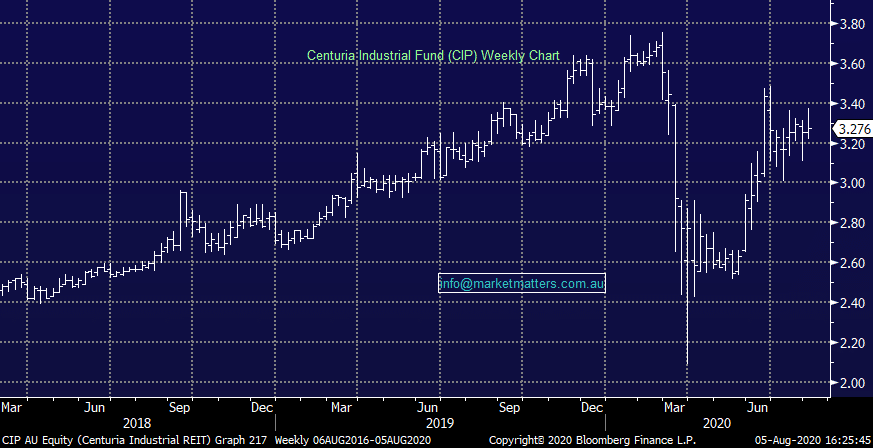

Centuria Industrial REIT (CIP) Chart