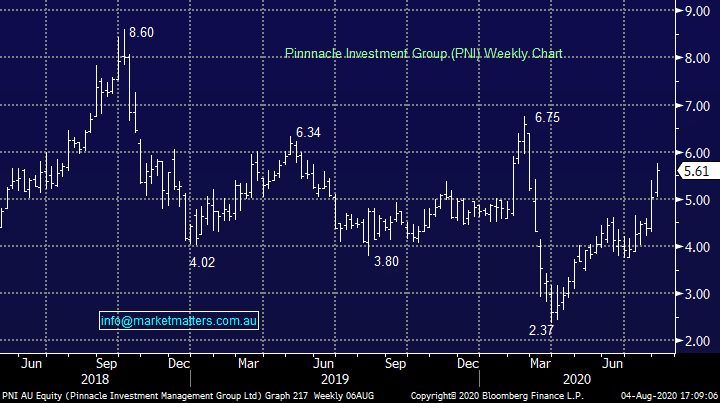

Pinnacle (PNI) recovers to pre-COVID levels

Pinnacle (PNI) +10.22%

Jumped out of the gates today continuing the recent strength to rally to 5 month highs on the back of a strong full year report. Pinnacle, which provides support frameworks and distribution for a number of boutique funds it also invests in, saw profit climb 5.6% to $32.2m for FY20 despite the volatility in markets over the 12 months. Key to the result was ~15% increase in profit from its equity interest in the managers with 5 out of the 16 affiliate funds producing a performance fee, while part of the growth also came from the stake purchased in Coolabah Capital in December. FUM across the network grew $4.4b in the period with $3b inflows & an additional $3b in acquired funds (Coolabah) more than offsetting $1.6b of negative performance.

Pinnacle is doing a lot right in the funds management segment which is facing a big structural shift – for the most part boutique funds are struggling to get going as large players with low costs dominate flows. Pinnacle has found a way to leverage the often-better returns of smaller funds on a larger scale, while using its distribution platform to generate flows which drops down to returns on the equity stakes. We like this business

Pinnacle (PNI) Chart