Emeco (EHL) result shows positive progress

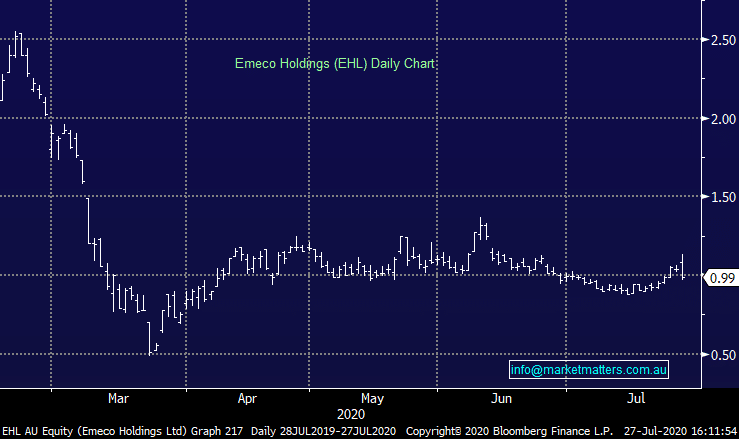

Emeco Holdings (EHL) -4.81%

Ended the session down today after initially rallying +7% on a good set of FY20 results. It looks to me like the stock rallied pre-result which smells a little but I’d also think that some large cap managers are taking this as a selling opportunity after EHL was removed from the ASX 200 at the last re-balance. Despite the mkt reaction, the result itself looked good with the highlights being:

- Operating EBITDA came in at $246.1m which was an increase of 15% on FY19, although that does include 4 months’ worth of Pit N Portal which they acquired in the period. They’d previously guided to EBITDA of between $244-247m so todays result hit the upper end of the band

- They’d targeted a net leverage ratio of 1.5x and got to 1.46x which is positive. Leverage has been an issue in this business however they’ve been progressively working to reduce this – more work to do however the trend is positive

- The rest of the result looks good relative to the level the stock is trading at, their exposure to Coal has been clearly been a negative, and it still accounts for 49% of total revenue which is down from 65% but still high none-the-less and weak coal prices hurt.

- They are expanding their resource base with Gold mining a clear opportunity for them.

Emeco Holdings (EHL) Chart