Perpetual (PPT) buys US fund manager

Perpetual (PPT) unch

Moved to raise $270m today as it looks to buy a controlling stake in US fund manager Barrow Hanley. The Aussie fundie will pay $US319m for the 75% stake, with around half of the price coming from existing cash and a new debt facility along with today’s equity raise. New shares will be issued at $30.30, a little under a 10% discount to Friday’s close with $225m placed to institutional investors and retail holders given the opportunity to take up shares in the SPP to come.

The Perpetual CEO Rob Adams was a key executive at Henderson during the merger with Janus a few years ago and has evidently taken a different direction on this deal. Barrow Hanley will add 21 strategies and more than triple the FUM under the Perpetual banner while the price comes at a steep discount to the earnings multiple Perpetual trades om (17x v 12x). The remaining 25% of Barrow Hanley will be held by the fund managers who elected to hold on to stock despite being given the option to sell down. Fund managers perform better when they hold equity upside, so I imagine Adams was happy to see the money managers holding tight.

We like the deal, though it does add some new outcomes to consider given we hold PPT in the income portfolio. For now there is no expected change the company’s policy of paying out between 80-100% of earnings, but they did flag changes to come looking to “strike a balance between maximizing returns… retaining cash to fund operations and repay debt” while franking will also be impacted given the international portion of earnings. For now though, PPT expect to announced underlying earnings for the full year of $93.5m which would lead to a dividend of up to 88cps, inline with current market expectations. A big acquisition for PPT that will be ~20% earnings accretive in year 1.

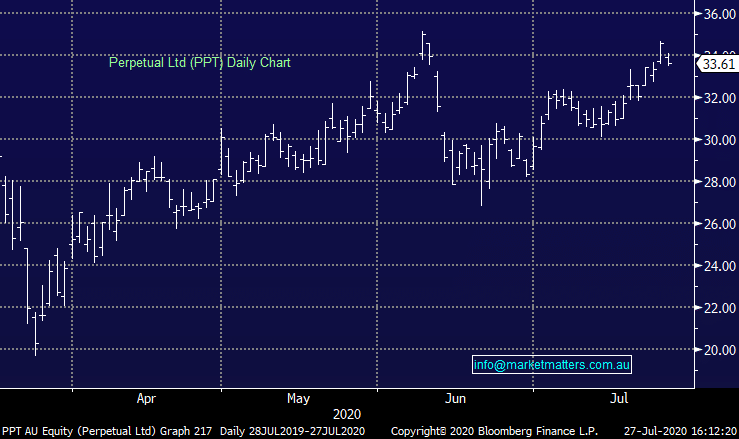

Perpetual (PPT) Chart