Bluescope (BSL) managing well despite interuptions

BlueScope Steel (BSL) +3.02%

Found some supporters in the analyst department with a number of brokers pushing price targets higher after pre-releasing FY20 results late last week. The company guided 2nd half EBIT to “around $260 million” which would be -48% on last year, taking full year EBIT to around $560m, off ~60% on FY19. The market’s initial reaction to sell on Friday was more than reversed by today’s move higher. The market had taken a knife to earnings after BlueScope withdrew guidance in March, though today’s announcement has come in just 7% below the previous figure.

The company said that Australian demand was little changed on the first half, and while demand from car manufactures had fallen with shutdowns, the North Star site had maintained utilisation rates above 90%. North America saw the benefit of an improved manufacturing performance and while performance in Asia was mixed, it doesn’t look as poor as first feared. It is another example of the panic that COVID brought far outweighing the impact to the business and the market being forced to boost estimates. They also commented on the start of FY21, saying that steel spreads had tightened while continuing to flag further impacts of COVID. BlueScope is in a good position to benefit from a broader economic recovery though and one to keep an eye on for global growth exposure.

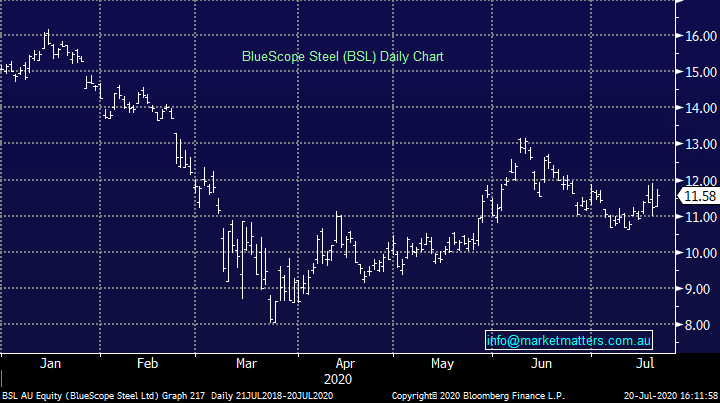

BlueScope Steel (BSL) Chart