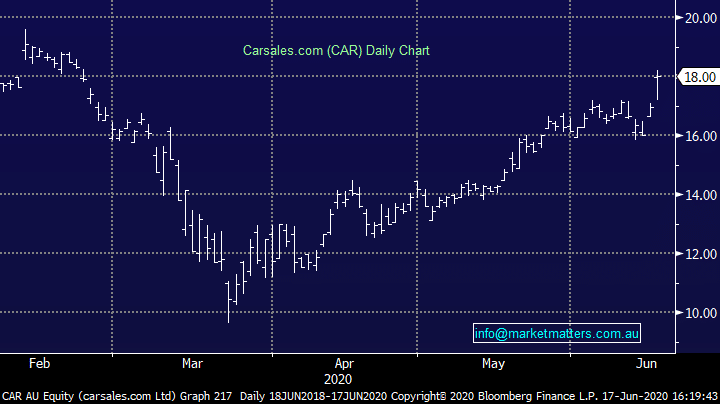

Carsales.com proving rebound in activity is on

Carsales (CAR) +6.19%: one of the better performers today, the online vehicle classifieds saw shares jump on a reasonable guidance figure, talking up the rebound in activity since April. The company expects around 7.5% lower for the full year at $120-124m, on a fall of ~5.5% in revenue. The market was looking for $111m, guidance coming in at ~10% above expectations. As the economy beings to reopen, car buys have returned to the market, helping to reduce inventory on the site with some demand likely coming from people looking to avoid public transport amid the pandemic. On the international front, their South Korean market has rebounded similarly to the Australian market, but the Brazilian arm continues to lag with daily COVID cases still rising in the country.

Carsales were also able to renegotiate their debt facilities, with an additional $105m made available, with the bulk now expiring out in 2024. The flexibility this provides is key, with Carsales in good shape from a balance sheet perspective. Management are still keen to pay dividends at around 80% of net profit – on that basis shareholders could expect another 18c for the final div, taking it to 40c for the financial year.

Carsales (CAR) Chart