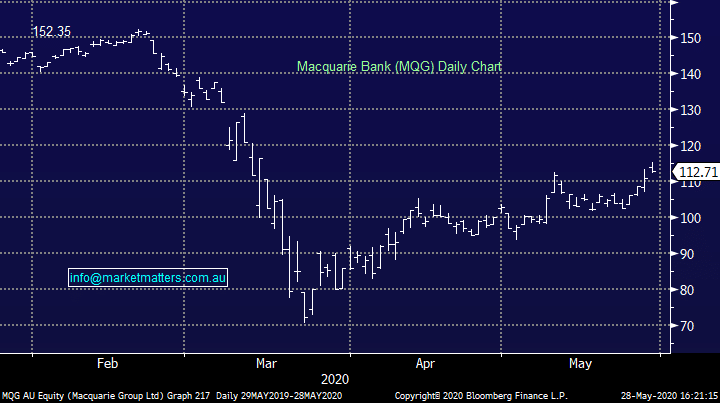

Macquarie (MQG) secures more capital

Macquarie Group (MGQ) +1.59%: traded higher with the market, or it could be that the market traded higher with Macquarie today. Overnight the investment bank managed to secure $US750m of tier 2 debt against the bank side of the business, at a margin of 295bps over Treasuries – a pretty tight number. They started marketing the deal at a margin of 350bps, but tightened the spread given that it was 10x oversubscribed. The deal is around equivalent to 326bps over the BBSW, which makes the recent MBLPB deal look particularly cheap priced at 470bps over swap – these start trading next week and if the news overnight is anything to go by, we would expect these to open higher than the $100 face value.

The raise is the second debt deal completed by Macquarie in recent weeks, and begs the question of what they are up to here. The tier 2 deal was also a driver of the market itself - it highlights the health of debt markets at the minute with increasing liquidity. A company that can access money is much safer than those that can’t implying investors are happy to take on risk in this environment.

Macquarie Group (MQG) Chart