Blackmores (BKL) the latest to tap shareholders

Blackmores (BKL) Halted-: kept in a trading halt today as they try to raise around $115m to “accelerate growth initiatives” in an effort to produce more sustainable and profitable growth according to the announcement. The raise comes 3 months after a disappointing half year result where expectations were reset despite seemingly receiving a boost in demand on immunity products. This demand has continued, while other parts of the business has been held back by “lower shopping traffic and supply chain constraints.”

Probably most disappointing was that Marcus Blackmore, who owns around 18.5% of the shares of issue, stated he would not participate in the capital raise. With such a large holder on the sidelines, it doesn’t instill a great deal of confidence in the capital raise. The institutional placement of $92m is underwritten, getting the SPP up to size may be a harder task. New shares will be issued at $72.50/share, around 8% below the last traded price. BKL presented to us a few weeks ago and I left the presentation unimpressed. Certainly not one we want to own.

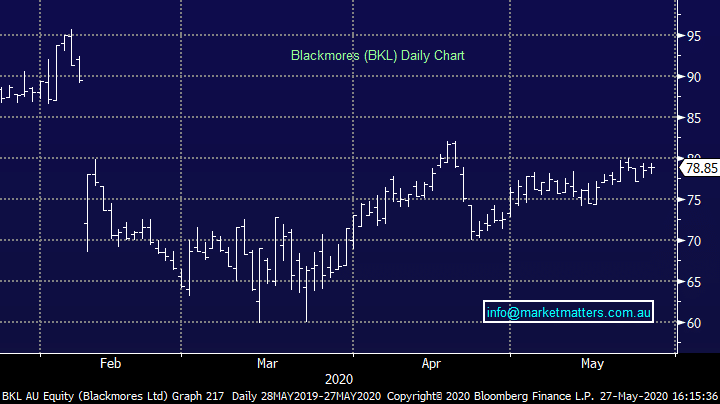

Blackmores (BKL) Chart