Australian Agriculture (AAC) post record wagyu sales

Australian Agricultural (AAC) +3.26%: This integrated cattle and beef company started life back in 1824 and now runs the largest herd of Wagyu Beef in Australia. It’s a stock I’ve always looked at with an eye to buy given its exposure to a growing Asian middle class and their rising consumption of beef, however it’s always had its challenges and the technical picture has been muted.

Today they delivered an improved FY20 result and while its not a well-covered stock (only Bell Potter cover it I think), today’s result was well ahead of their expectations. AAC said they had a record year of Wagyu meat sales +19.7% plus prices were also up by 8%. They saw growth across all key regions: Asia +19%, Europe/ME +17%, NA +34%, Australia +16% and they delivered their strongest operating cash flow since FY17, achieving positive cash flow in four out of the last five halves. This better backdrop flowed through to a increase in net assets which were up 8% to ~$913M. There pastoral properties valuation increased $63.6M, the value of livestock increased by $49.6M dropping down to an NTA per share of $1.53 per share vs $1.42 this time last year. Gearing always an important issue with a business like this and pleasingly, gearing ratio was 30% post accounting standard changes within the targeted 20-35%, although at the higher side. The stock closed today $1.11. Well worth a deeper dive in our view.

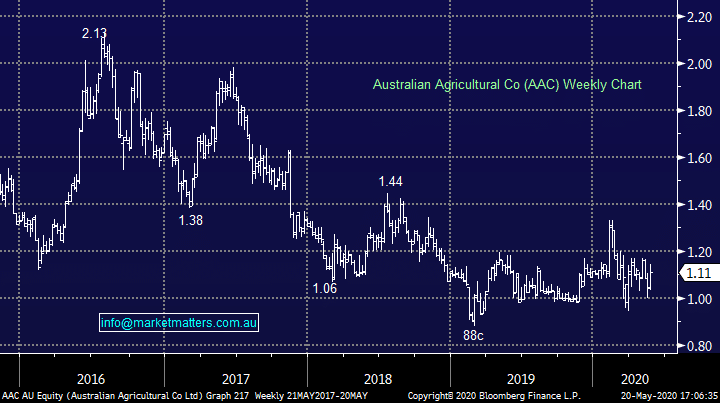

Australian Agricultural (AAC) Chart