Macquarie Conference wraps up

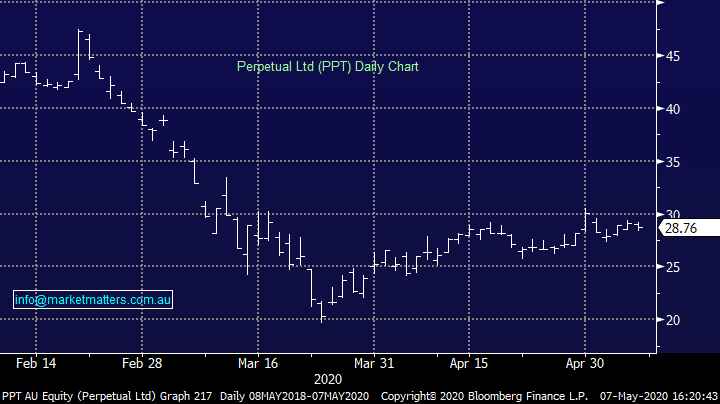

Macquarie Conference: a few big hitters rounded out the final day of the virtual conference today. Beach Petroleum (BPT) was the last of the energy names to talk, trumpeting their strong balance sheet and capex flexibility as well as the large portion of earnings that come from fixed price contracts or hedged production. We own Beach in the Growth portfolio with today’s presentation justifying exactly why. They are a low cost, high quality producer with a diversified product mix. Key to their ability to survive the oil market slump is that 97% of production in FY21 is already contracted while costs continue to come down. They also said they were “confident in long term oil and gas fundamentals” implying the price of oil will revert higher as production comes off and demand returns. BPT closed 2% higher while other energy names were mostly weaker.

Beach Energy (BPT) Chart

Caltex (CTX) was marginally higher today despite spending much of the presentation talking to the slump in petrol demand. They noted jet fuel demand was down 80-90% currently while retail fuel had fallen 16% year to date, though this does include time pre-lockdown. Capex has been cut, and costs are being stripped where they can, including retail worker hours cut back. Caltex continues to assess how it can unlock value in the property, considering an IPO of the property portfolio. Caltex was under takeover recently, and it will be interesting to see if the bidders return at a cut rate price given the fall in the shares.

Spark Infrastructure (SKI) reaffirmed their distribution guidance ahead of their presentation today, keeping the minimum payout of 13.5cps over the full year. Spark noted higher operating expenses as well as a reduced demand for energy in March. South Australia saw the biggest decline in usage, falling 11.1%. Despite the squeeze, they do have a reasonable look through of revenues through the rest of the year, and recently secured further funding for growth.

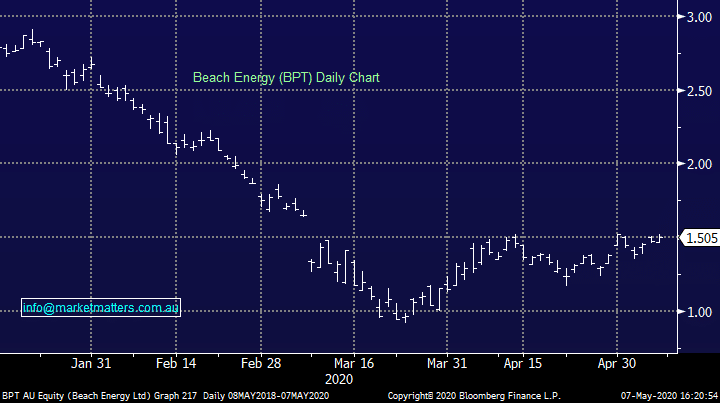

Perpetual (PPT), a stock we hold in the Income Portfolio also presented today and they spoke of the diversity in their business over and above a straight fund manager. We like their diversified lines and remain comfortable holders.

Perpetual (PPT) Chart

Caltex (CTX) was marginally higher today despite spending much of the presentation talking to the slump in petrol demand. They noted jet fuel demand was down 80-90% currently while retail fuel had fallen 16% year to date, though this does include time pre-lockdown. Capex has been cut, and costs are being stripped where they can, including retail worker hours cut back. Caltex continues to assess how it can unlock value in the property, considering an IPO of the property portfolio. Caltex was under takeover recently, and it will be interesting to see if the bidders return at a cut rate price given the fall in the shares.

Spark Infrastructure (SKI) reaffirmed their distribution guidance ahead of their presentation today, keeping the minimum payout of 13.5cps over the full year. Spark noted higher operating expenses as well as a reduced demand for energy in March. South Australia saw the biggest decline in usage, falling 11.1%. Despite the squeeze, they do have a reasonable look through of revenues through the rest of the year, and recently secured further funding for growth.

Perpetual (PPT), a stock we hold in the Income Portfolio also presented today and they spoke of the diversity in their business over and above a straight fund manager. We like their diversified lines and remain comfortable holders.

Perpetual (PPT) Chart