Macquarie Conference day 2

Macquarie Conference: Day 2 of 3 of the conference today with one of our holdings taking to the virtual lectern. Tomorrow has Caltex, Perpetual and Beach energy among the big names, but today presenter Bingo (BIN) initially traded higher before tracking lower through the afternoon. The company-maintained margins above 30% through the third quarter, on track to reach previous guidance despite talking down the fourth quarter as the COVID impact takes hold. Bingo has been trying to push through price increases across the portfolio and the virus appears to have put this on the back burner for the moment. The balance sheet remains robust with plenty of debt headroom as well as un-utilized land that looks set to be sold. Despite that, we have noted before that Bingo is not cheap and doesn’t have much wiggle room from the market for its shares to keep moving higher. Competitor Cleanaway (CWY) took over the conference a short time later with their shares performing a little better. The Toxfree acquisition remains on track for a June completion despite the continuing market issues, while they noted smaller acquisitions may become available over the next few years.

Appen (APX) seemingly presented well, with shares now better than pre-virus levels. The company talked up its resilience, noted in the recent reconfirmation of guidance in mid-April, while talking up their workplace flexibility and customer base. Shares edged higher throughout the day to close nearly 9% better.

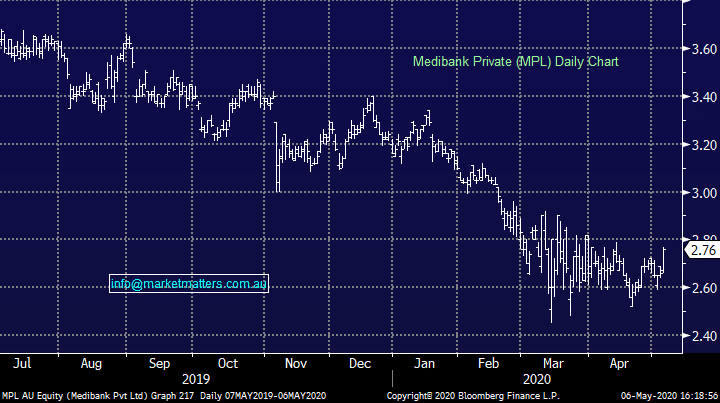

Medibank Private (MPL) had the floor just before lunch with their presentation talking down policy growth as a result of closed stores, but also talking up retention. While Medibank has provided a $50m support package aimed at delaying premium increases and payments, it has also seen claims drop significantly with procedures being put off. The virus may be a wake up call for many Australians without private health insurance as the ‘rainy day’ event becomes more front of mind, though with the economy going backwards, the discretionary spend of insurance may be pegged back.

Medibank Private (MPL) Chart