Bendigo (BEN) raises capital

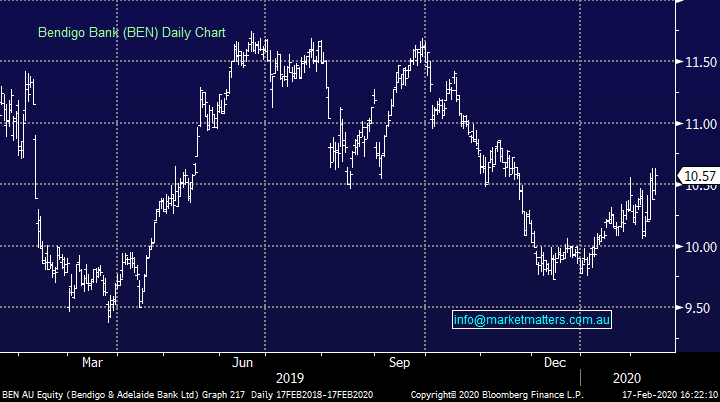

Bendigo Bank (BEN)

The regional was out with 1H20 results yesterday and as widely expected, they also launched a $300m capital raise to boost their balance sheet. In terms of the result, they experienced 1% loan growth on the half, which included a 3% increase in residential lending offsetting a decline in commercial lending. Like the other banks, expenses are up, in BEN’s case by 1% which was actually a good result although not included here was a big $61m software impairment, basically they are writing down old to then build new. This is one of the reasons why merging with another regional like a BOQ would make sense given the increasing demands for costly systems to remain competitive.

In terms of dividend for the half, it was cut to 31 cps down from 35cps and it probably won’t increase for some time. In short, the outlook includes rising expenses and downward pressure on margins. The institutional component of the cap raise was completed at $9.34/sh, raising a total of $250m with the remainder to be rustled up in a share purchase plan (SPP). The price represents a 11.6% discount to Friday's close price and was reportedly well bid into by the institutional market. Shares are currently trading around 6.5% lower, covering more than half of the capital raise discount.

Bendigo Bank (BEN) Chart