Why Commonwealth Bank (CBA) will rally today

CBA released 1H earnings this morning that are ~3% better than expected. Cash NPAT came in at $4.477b for the half versus $4.344b expected. Earnings per share (EPS) printed $2.53 v $2.44 expected, a ~3.7% beat while the all important dividend remained flat at $2.

Earnings were down -4.3% on 1H19 due to a flat top line but rising costs. Operating income was $12.416b, stable on this time last year, while impairments were 12.5% higher and operating expenses were up 2.6%. Net Interest Margins (NIM) were 2.11%, up 1bpts.

A good result in a tough environment.

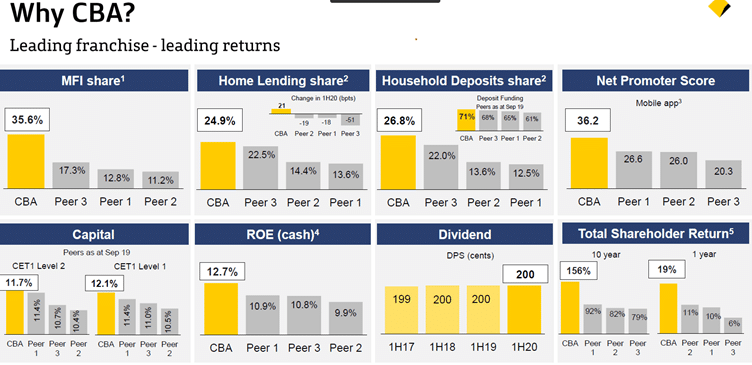

One slide in the pack shows why CBA trades on 17.1x versus the sector on 13.4x, simply it’s the sector leader in home loans, deposits, capital, ROE and total shareholder return.

While this is clearly a good result and above expectations, we ponder whether or not this had already been priced in given the strong outperformance in recent months.

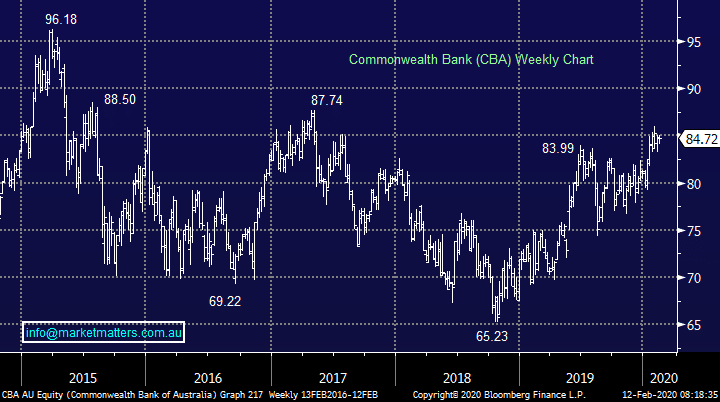

Commonwealth Bank (CBA) Chart

While this is clearly a good result and above expectations, we ponder whether or not this had already been priced in given the strong outperformance in recent months.

Commonwealth Bank (CBA) Chart