Fortescue (FMG) announces impressive quarter, stock slides on iron ore

Fortescue Metals (FMG) –2.08%: Great set of production numbers from FMG today with an upgrade to FY guidance to boot, albeit a small one (+1.5%). Lots of interest in FMG so worth delving into the detail on this with Peter O’Connor’s (Shaw) comments as follows….A good set of numbers which were in line with ship tracking data (weekly) so no surprise but nonetheless a good way to wrap up the half year. Shipments of 46.4mt, nine per cent higher than Q2 FY19 bringing first half shipments to a record 88.6mt. C1 costs of US$12.54/wmt, four per cent lower than Q2 FY19. FY20 Guidance upgraded. Based on the trend of 1H20 results – production, sales and costs – FMG has upped FY20 shipment guidance by ~1.5% and lowered cost guidance by ~3.7%.

o Shipments at the upper end of the range of 170 - 175Mt,

o C1 costs in the range of $12.75-13.25/wmt vs previously guided $13.25-13.75/wmt.

o Confirms total capital expenditure of $2.4B

· Price. Fortescue’s average revenue was US$76/dmt in the quarter. The average price realisation was 86 per cent (we were looking at 88%) of the average 62% CFR Index price of US$89/dmt for the quarter. The closing Platts 62% CFR Index price at 31 December was US$92/dmt (US$93/dmt at 30 September 2019).

· Earnings sensitivity. All else equal these two updated guidance inputs would lift FY20 earnings by 1.7% whilst the slightly lower price realisation (86% vs 88% expected) would take 2.2% off earnings = net down 0.5% for FY20.

· Financials. Net debt has declined to a low US$0.7bn ü We expect the trend of allocating FCF to projects and dividends to continue especially with net debt now almost nil.

· Pilbara power solution. Developing iron ore project now has a comprehensive (and carbon reduced) energy solution, the Pilbara Generation project” involving both transmission and generation assets for a combined $700m. Worth noting that 50% of power to be sourced from renewables.

We like FMG, but at lower levels. Today’s sell off implies a lot of good news already baked into the price.

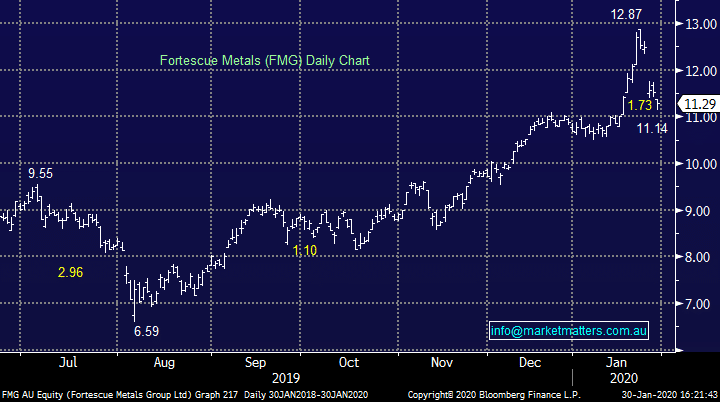

Fortescue Metals (FMG) Chart