Subscriber Questions – Ethical Investing, NEA and WZR

**This is an extract from the Market Matters Morning Report from 28 January. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 2

Can you suggest a suitable: *Ethical Global ETF *Ethical Australian ETF for me to look at investing in, taking a long-term view or do you have a report on this available? (I appreciate that you can't recommend anything)” - Thanks Simon R.

Hi Simon,

I certainly understand your feelings and with an increasing number of investors feeling the same way I’m glad to see the volume and quality of the offerings continue to increase. One consideration however is that your ethical position might be different to what is covered in the ETFs.

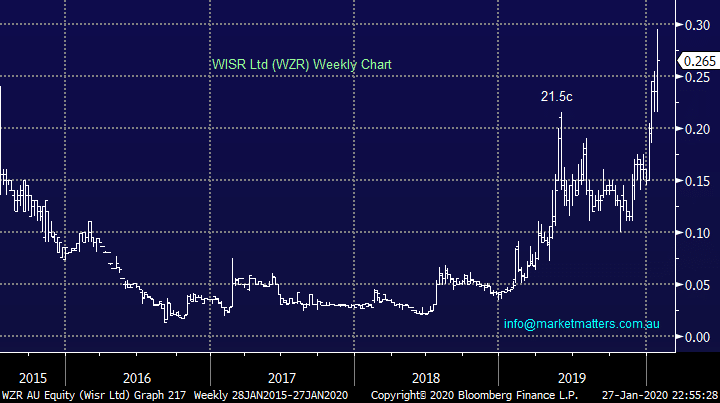

The largest option traded locally is the BetaShares Global Sustainability Leaders ETF (ETHI) which currently has market cap of almost $540m however it has Mastercard and Visa as 2 of the 3 top holdings, credit cards perhaps may not fit your ethical stance.

BetaShares Global Sustainability Leaders ETF (ETHI) Chart

Question 3

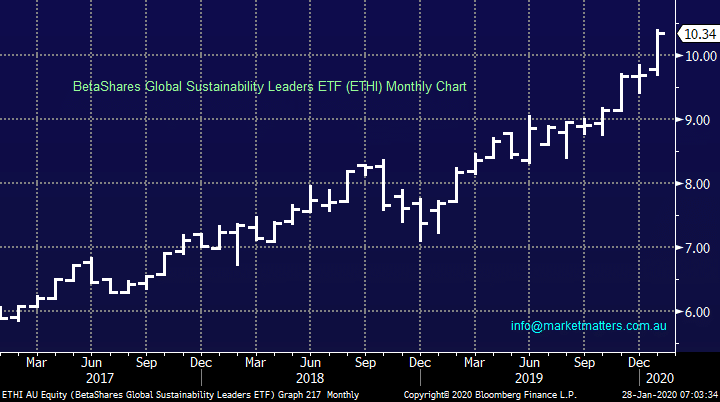

“Dear Market Matters Team, I was interested to see if you had a view on any of the aerial mapping companies such as Nearmap Limited (NEA) or the recently listed Aerometrex Limited (AMX). Nearmap looks to have had a large pull back in the middle of last year and tracking sideways at the moment. Could there be a rerating if good news comes from its US expansion or has that already been priced into the stock?” – Cheers Paul A.

Hi Paul,

NEA is a $1.1bn business which continues to carry a short position of over 12% making it the 7th most shorted stock in the ASX, very rarely an attractive indicator. The markets concerned around the company’s future growth as competition increases from the likes of AMX which you mentioned in the question hence NEA is not one for us at this stage:

MM is neutral / bearish NEA.

The newly floated AMX is harder to gauge and we would rather put this one in the wait and see category.

Nearmap Ltd (NEA) Chart

Question 3

“Dear Market Matters Team, I was interested to see if you had a view on any of the aerial mapping companies such as Nearmap Limited (NEA) or the recently listed Aerometrex Limited (AMX). Nearmap looks to have had a large pull back in the middle of last year and tracking sideways at the moment. Could there be a rerating if good news comes from its US expansion or has that already been priced into the stock?” – Cheers Paul A.

Hi Paul,

NEA is a $1.1bn business which continues to carry a short position of over 12% making it the 7th most shorted stock in the ASX, very rarely an attractive indicator. The markets concerned around the company’s future growth as competition increases from the likes of AMX which you mentioned in the question hence NEA is not one for us at this stage:

MM is neutral / bearish NEA.

The newly floated AMX is harder to gauge and we would rather put this one in the wait and see category.

Nearmap Ltd (NEA) Chart

Question 9

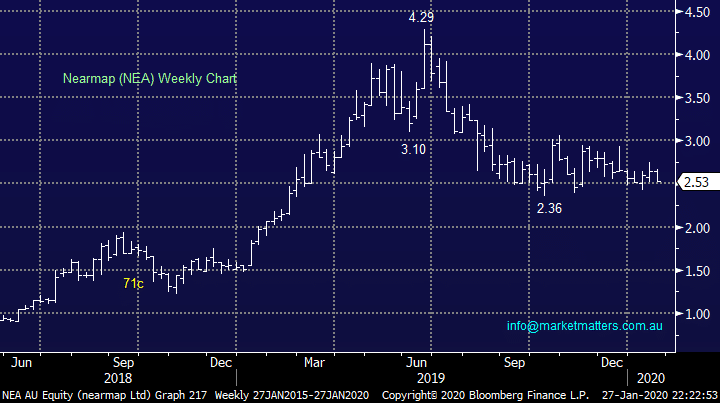

“Hi guys, I'm keen to get your opinions on WISR (WZR). As has been mentioned in some of market matters previous reports the recent placement has been massively oversubscribed, and the stock has good momentum. Is this a buy at current prices or is there a better technical entry level?” - Cheers, Mitch N.

Hi Mitch,

New lender on the block WZR has been soaring since early 2019, not surprising as the company lent almost $55m in H1 of 2020 FY almost doubling the previous corresponding period. We feel WZR is well placed in the personal lending market moving forward but it’s tricky to value at this stage hence we would be using technicals to quantify the risk / reward.

We were involved (through Shaw) in the recent placement and received around 11% of bid amounts, it’s was extremely well bid.

MM likes WZR with stops under 20c.

WISR Ltd (WZR) Chart

Question 9

“Hi guys, I'm keen to get your opinions on WISR (WZR). As has been mentioned in some of market matters previous reports the recent placement has been massively oversubscribed, and the stock has good momentum. Is this a buy at current prices or is there a better technical entry level?” - Cheers, Mitch N.

Hi Mitch,

New lender on the block WZR has been soaring since early 2019, not surprising as the company lent almost $55m in H1 of 2020 FY almost doubling the previous corresponding period. We feel WZR is well placed in the personal lending market moving forward but it’s tricky to value at this stage hence we would be using technicals to quantify the risk / reward.

We were involved (through Shaw) in the recent placement and received around 11% of bid amounts, it’s was extremely well bid.

MM likes WZR with stops under 20c.

WISR Ltd (WZR) Chart