Subscriber Questions – WTC, BIN, CPU and more

**This is an extract from the Market Matters Morning Report from 25 November. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 1

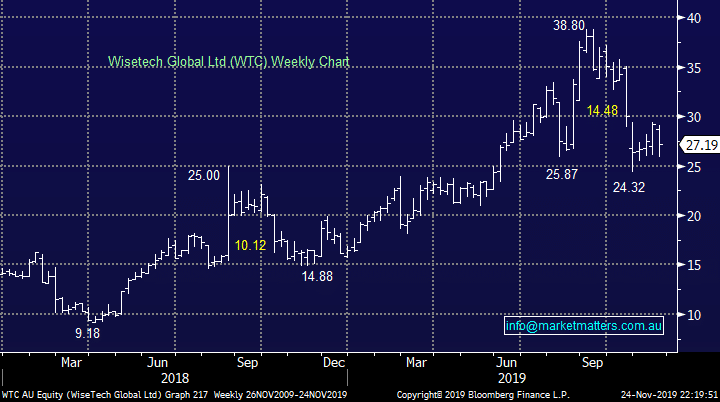

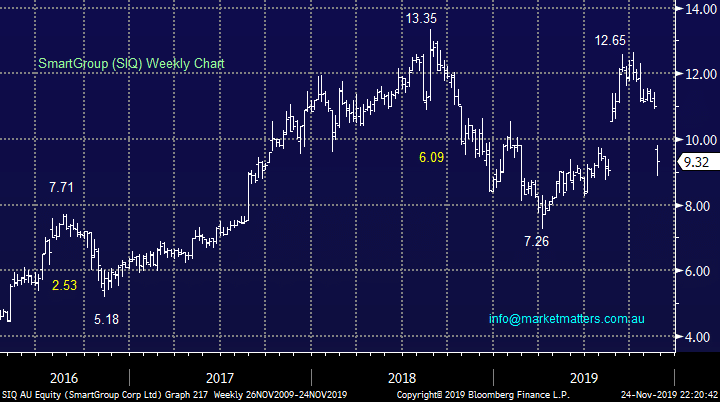

“Hi James and Team. Thanks for continuing excellent coverage of both the macro and micro elements of the markets. One matter that could help further is some additional opinion/comment in your evening reports on whether stocks that have dropped significantly on the day now represent good buying value (margin of safety), or if not, what even lower price should a trader/investor look for to buy at. Two examples in the last few days where such comment did not appear was SIQ (SmartGroup) and WTC (Wisetech), where despite your silence I have chosen to purchase some SIQ hoping for a short term uplift on an over-reaction, whereas with WTC I am still watching it closely.” - Regards, Gil.

Hi Gil,

Thanks for the positive feedback and importantly constructive thoughts, we are continually striving to improve the MM offering and hence totally appreciate ideas to assist in the ongoing goal. We do usually attempt to address most ASX200 stocks who have had major moves in the MM afternoon report but more detail analysis leading to specific opinion is clearly required at times, we will endeavour to improve this when possible but obviously at times we do like to digest the news overnight and discuss in the morning note, still allowing plenty of time for action.

With regard to the 2 stocks you’ve mentioned:

1 – Wisetech (WTC) $27.19 – we have touched on this cloud based logistics software business over recent weeks and our view has not waivered – MM likes WTC as an aggressive play below $24, or over 10% lower.

2 – SmartGroup (SIQ) $9.32 – the salary packaging company was smacked last week after announcing an in-line trading update and the stepping down of its long standing CEO. The respected departing CEO has been with the company for 19-years although early indicators are the transition looks to have been well thought out. Investors are clearly focusing on the combination of the fear of the unknown and the potential fresh 2.5% overhang of shares in the business but we question whether this warrants the huge stock revaluation.

We believe the sell off in SIQ is overdone and we are considering a purchase.

Wisetech Global (WTC) Chart

SmartGroup Corp (SIQ) Chart

SmartGroup Corp (SIQ) Chart

Question 2

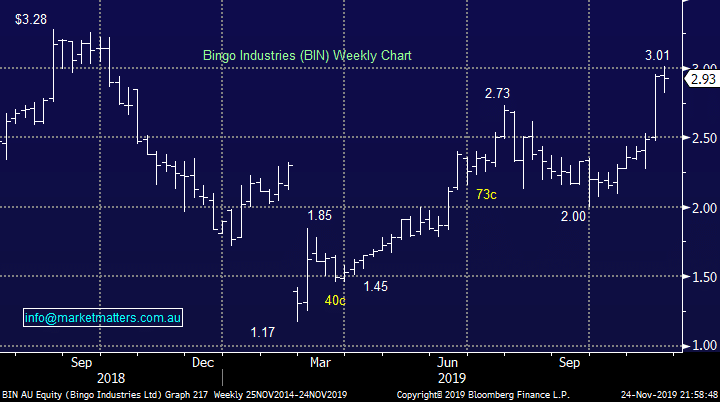

“Hi MM I have held on to BIN from earlier in the year. With their AGM update being positive and your view "bullish BIN after today’s news". ($3.01 share price will have me 100% up). Not to sound greedy -Should I Sell or hold for further upside. Should I be long BIN? Any further gains in this stock will help towards losses made in CGC, ORE & ABC.” - regards Debbie.

Hi Debbie,

Obviously we cannot give Personal Advice hence our comments are purely around how we see BIN moving forward – a stock in hindsight we were way too fussy with when it pulled back towards the $2 area in September.

Both the business operationally and stock technically look solid but clearly its already up ~50% over the last few months. We expect the shares to now “take a breather” and rotate around the $3 area into 2020, a break below $2.70 would be a concern technically.

MM is neutral to bullish BIN around current levels.

Bingo Industries (BIN) Chart

Question 2

“Hi MM I have held on to BIN from earlier in the year. With their AGM update being positive and your view "bullish BIN after today’s news". ($3.01 share price will have me 100% up). Not to sound greedy -Should I Sell or hold for further upside. Should I be long BIN? Any further gains in this stock will help towards losses made in CGC, ORE & ABC.” - regards Debbie.

Hi Debbie,

Obviously we cannot give Personal Advice hence our comments are purely around how we see BIN moving forward – a stock in hindsight we were way too fussy with when it pulled back towards the $2 area in September.

Both the business operationally and stock technically look solid but clearly its already up ~50% over the last few months. We expect the shares to now “take a breather” and rotate around the $3 area into 2020, a break below $2.70 would be a concern technically.

MM is neutral to bullish BIN around current levels.

Bingo Industries (BIN) Chart

Question 3

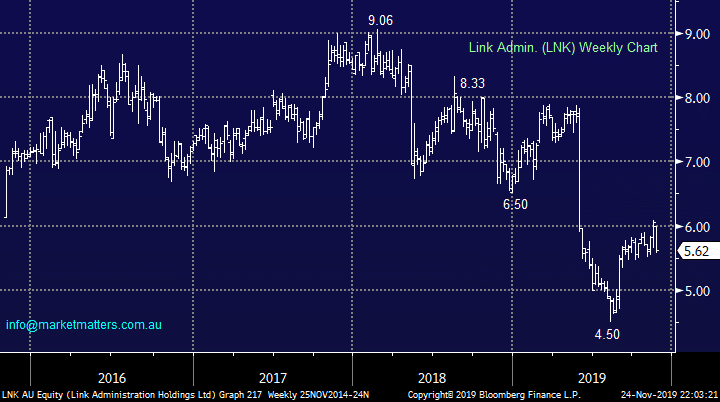

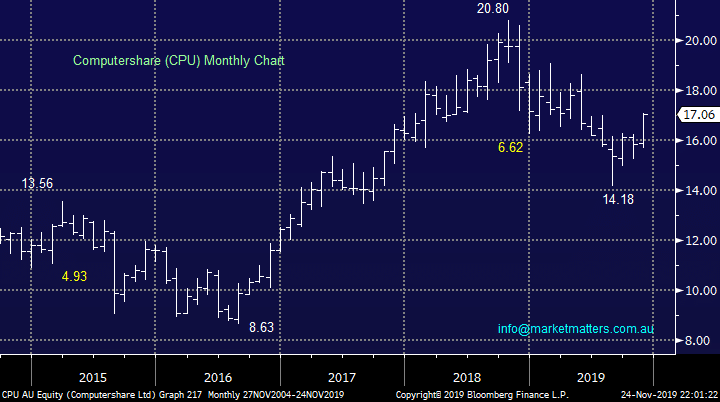

“LNK vs. CPU What's your take on each of LNK and CPU and against each other and also for the category? I read that the new ASX blockchain system might be a risk for both since it potentially sidelines them from share registry type services or at least diminishes their role in it.” - Cheers! Dave B.

Hi Dave,

An fascinating question on 2 companies that have corrected significantly from their 2018 highs – 32% for Computershare (CPU) and 50% for Link Admin (LNK). The blockchain technology certainly does throw up risks in this space especially as it would appear that the ASX Ltd (ASX) has aspirations of vertical integration moving forward i.e. potentially controlling the market place and share registries.

We like to combine both fundamentals and especially technical risk / reward evaluation when this degree of disruption is a foot. Firstly we prefer CPU over LNK across both levels and interestingly on a technical level CPU actually looks excellent.

MM likes CPU with stops below $16, or ~6% risk.

Computershare (CPU) Chart

Question 3

“LNK vs. CPU What's your take on each of LNK and CPU and against each other and also for the category? I read that the new ASX blockchain system might be a risk for both since it potentially sidelines them from share registry type services or at least diminishes their role in it.” - Cheers! Dave B.

Hi Dave,

An fascinating question on 2 companies that have corrected significantly from their 2018 highs – 32% for Computershare (CPU) and 50% for Link Admin (LNK). The blockchain technology certainly does throw up risks in this space especially as it would appear that the ASX Ltd (ASX) has aspirations of vertical integration moving forward i.e. potentially controlling the market place and share registries.

We like to combine both fundamentals and especially technical risk / reward evaluation when this degree of disruption is a foot. Firstly we prefer CPU over LNK across both levels and interestingly on a technical level CPU actually looks excellent.

MM likes CPU with stops below $16, or ~6% risk.

Computershare (CPU) Chart

Link Admin. (LNK) Chart

Link Admin. (LNK) Chart