IVE Group share price ticks higher on M&A, AGM

IVE Group (IGL) +0.95%

Was out yesterday with an announcement about the purchase of Salmat’s (SLM) marketing solutions business which is Australia’s largest catalogue distribution business. There wasn’t a large amount of information in the release however more detail was provided at their AGM today, and the stock has reacted more favourably. Firstly on the acquisition, they’ve paid $25m upfront (completion January 2020) with a further $25-$30m capital investment to automate the division – this will be debt funded.

The purchase ties in with their strategy of being completely vertically integrated end to end provider within the marketing and communications industry, and importantly, they believe the acquisition will be earnings accretive in FY20. At their AGM today they talked about the quality of their FY19 result and presented a fairly upbeat assessment for FY20, although they provided specific guidance. Trading on just 9x and yielding ~7.5% fully franked, this is a business that should be trading higher. We hold IGL in the Income Portfolio

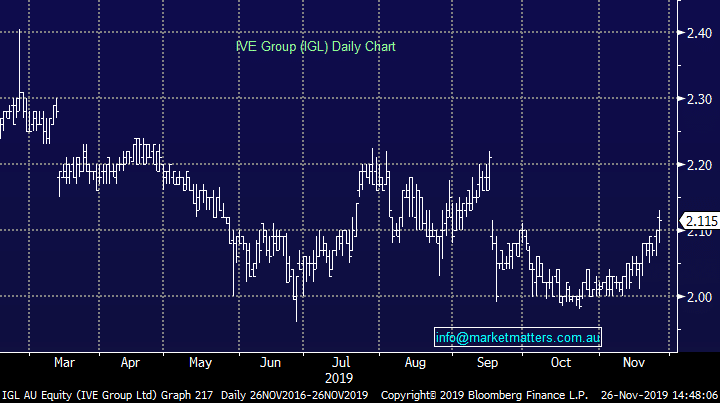

IVE Group (IGL) Chart