IOOF banks savings on ANZ transaction

Stock

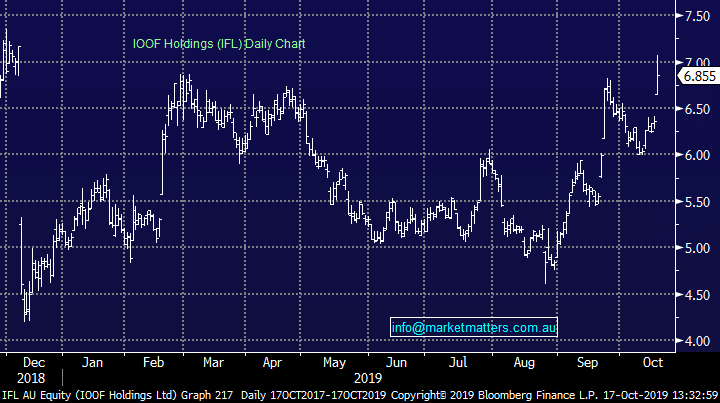

IOOF (IFL) $7.00 as at 17/10/2019

Event

The turnaround in recent months for IFL continued today, with the stock leading the index gains by adding 10% so far in the session against the backdrop of the ASX200 which has fallen 0.2%.

IOOF was out with an update on their acquisition of ANZ’s OnePath Pensions & Investments business which was feared to be dead in the water following regulatory issues which has dragged the acquisition process out over 2 years. Today IOOF was out alongside ANZ to announce that the price of the deal would be lowered by $125m to $825m. Both parties also agreed to extend the termination date of the transaction if conditions had still not been met from today out to 31 December.

Back in 2017 when the deal was initially announced, IFL tapped the market for around half of the cost of the transaction, raising capital at $10.60 a share, or 50% higher than the current share price. Now, with the deal almost over the finish line, the company could be set to launch a share buyback at a deep discount to the raise price. The last hurdle will be APRA sign off which carries some risk given how they have handled IOOF in recent times.

IOOF (IFL) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook