Santos (STO) splashes the cash to buy north Australian assets

Stock

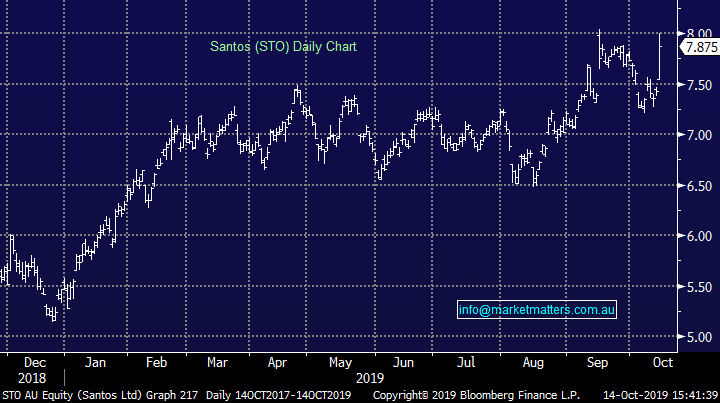

Santos (STO) $7.90 as at 14/10/2019

Event

Santos has stormed ahead of the strong Energy sector today after announcing a deal to buy a number of assets in the northern parts of Australia. The $US1.4b deal with ConocoPhillips will see Santos take on interest in 4 LNG projects – Darwin LNG, Bayu-Undan, Barossa and Poseidon, effective from 1st January this year.

The acquisitions will be fully funded by cash and debt facilities already available to Santos which has done a good job of deleveraging the balance sheet in the past few years. It adds a number of low cost assets onto the balance sheet and despite Santos already being one of the lowest breakeven produces, the new assets will reduce their breakeven oil price by another $US4/barrel as well as increasing production by around 25%.

The Darwin LNG plant currently services the Bayu-Undan project producing around 3.7 mtpa however it is expected to run dry in 3 years. The Barossa project is expected to plug the gap while plans are in place to increase capacity at the Darwin plant by more than double.

The announcement highlights the recent change in tack from Santos which was forced to bunker down just a few years ago when falling oil prices put the balance sheet under pressure. Now they have completed two big deals in the past year or so after picking up Quadrant for $2.15b late last year.

Santos (STO) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook