CBA PERLS XII Capital Notes

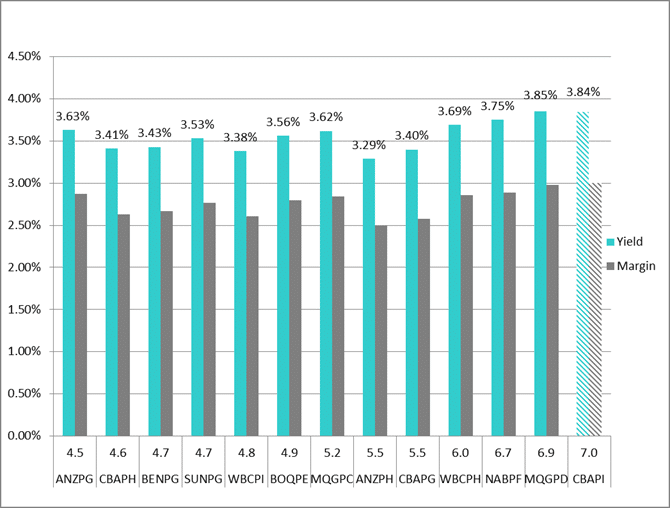

**This is an extract from the Market Matters Income Report from 9 October. Click here to get access to the full report and more CBA this morning have a launched a new hybrid security, looking to raise ~$750m, however they’ll likely do more. This is a tier 1 security structured in a similar way to existing CBA PERLS Capital notes on issue. The margin is likely to be 3% over the 90 day bank bill rate which equates to a grossed yield of ~3.84%. Key Points

- Commonwealth Bank of Australia (ABN 48 123 123 124), (“CBA” or “Issuer”), launched a $750 million subordinated, unsecured notes issue which will be listed on the ASX (“CommBank PERLS XII Capital Notes” or “PERLS XII

- Bookbuild close date: The Broker Firm Offer Bookbuild will close on 14 October 2019 and may close early and quickly.

- The Margin is expected to be between 3.00% to 3.20% per annum and will be determined through the Bookbuild.

- First call date is 20th April 2027, hence this should be viewed as a long dated security

The Offer is being made pursuant to the Prospectus, which contains full details about the Offer and should be read in its entirety (particularly the investment risks set out in Section 4) before deciding whether to apply for an allocation. Investments in securities such as these PERLS XII are subject to risks which could affect their performance, including the loss of investment and income. CBA (nor any other entity) guarantees the market price of PERLS XII or any particular rate of return. Investors can access the Prospectus here.

The Offer is being made pursuant to the Prospectus, which contains full details about the Offer and should be read in its entirety (particularly the investment risks set out in Section 4) before deciding whether to apply for an allocation. Investments in securities such as these PERLS XII are subject to risks which could affect their performance, including the loss of investment and income. CBA (nor any other entity) guarantees the market price of PERLS XII or any particular rate of return. Investors can access the Prospectus here.