Where to be positioned in the current equity market environment

**This is an extract from the Market Matters Weekend Report from 29 September. Click here to get access to the full report and more

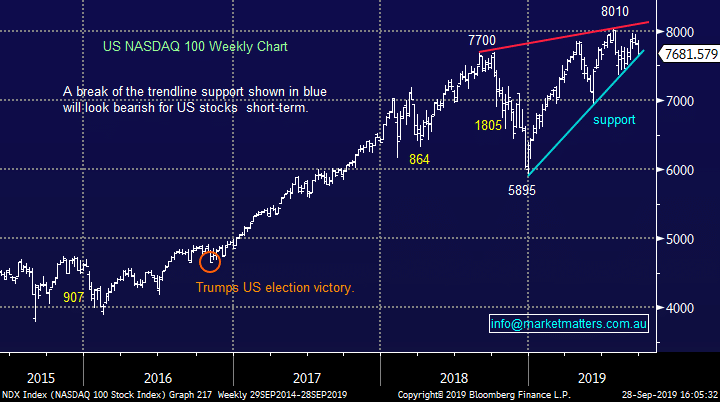

The ASX200 finished the week down only a few points, not a bad performance considering US stocks made a fresh 3-week low although moves were fairly muted across most markets throughout the week. On the sector level the cornerstone of our index, the banks, remained firm while the resources and Healthcare sectors were the noticeable laggards. Interestingly we saw bond yields drift lower both here and in the US but many of the stocks / sectors that have benefited from plunging interest rates actually closed down on the week, definitely no change in trend but we continue to believe that risks are mounting for the growth / yield play stocks that have enjoyed the history making decline by interest rates.

Figuring out the current market is akin to playing chess against Bobby Fischer, there are plenty of moving parts in the game with the most influential factors constantly changing while a left field checkmate continually feels possible. Undoubtedly many investors are not embracing this post GFC bull market but history tells us they die of excessive optimism not old age, implying that any decent dips in stocks should be bought. Also recession fears amid fund mangers are currently at their highest level in a decade, when people are scarred markets often rally, not fall. Hence most investors appear to be positioned in assets that enjoy low growth & interest rates, while avoiding value stocks – when this rotation does unfold it’s going to be huge.

At MM we have a negative bias from a risk /reward perspective in the short-term with our ideal target still around the 6300 area for the ASX200 but with stock / sector rotation dominating proceedings intra-week and the domineering Banking sector looking strong were not getting ahead of ourselves just yet. In fact on balance we are still 50-50 whether both the ASX200 and S&P500 can make a fresh 2019 high in early October but we don’t anticipate any meaningful follow through on the upside.

The SPI futures are calling the ASX200 to open down around 10-points on Monday following some tech focused selling on Wall Street, but with the Financials closing positive in the US there’s some definite hope for the local index early next week.

MM remains comfortable adopting a slightly more defensive stance around current levels.

ASX200 Chart

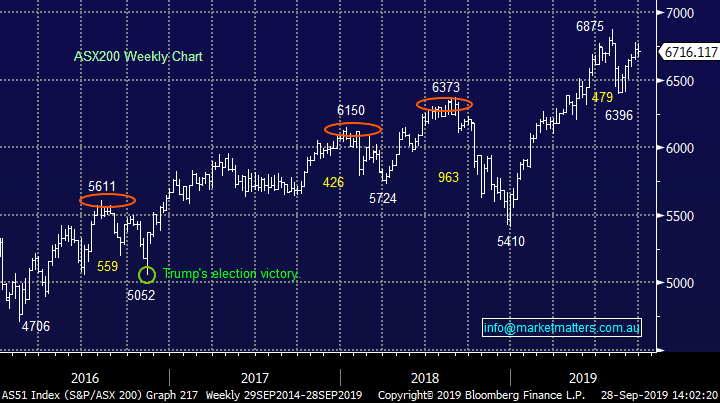

No major change again with US stocks, they closed lower after a choppy few sessions and still don’t want to commit in either direction but my “Gut Feel” is it’s just a matter of time until we see sharp sell—off. However while indices hold support another look above 8000 by the tech based NASDAQ cannot be ruled out.

MM expects US stocks to correct to the downside in October.

US NASDAQ index Chart

No major change again with US stocks, they closed lower after a choppy few sessions and still don’t want to commit in either direction but my “Gut Feel” is it’s just a matter of time until we see sharp sell—off. However while indices hold support another look above 8000 by the tech based NASDAQ cannot be ruled out.

MM expects US stocks to correct to the downside in October.

US NASDAQ index Chart