BlueScope shares fall on tight steel margins

Stock

BlueScope (BSL) $11.05 as at 19/08/2019

Event

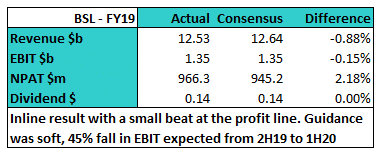

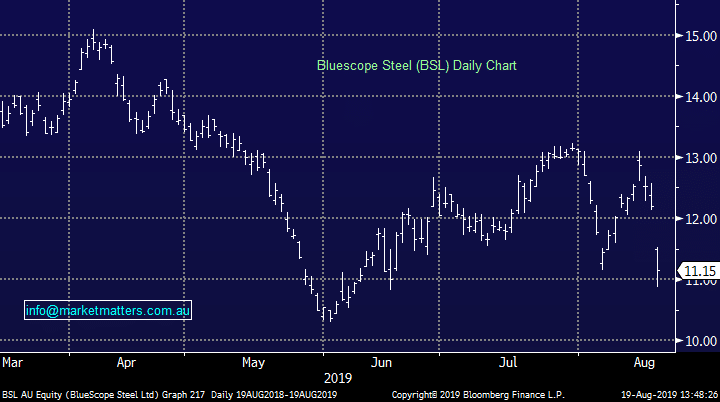

Australian steel producer BlueScope has tumbled today on their full year result, falling as much as 10.8% early in the session before some buying found its way in. The result was in line for the full year with NPAT coming in marginally ahead of expectations however investors seem to be spooked by the outlook statements given.

Shareholders will get a 14c full year dividend with income for FY19 in line with FY18. The company’s large cash balance is also being put to work in supporting the stock with buybacks currently in place. Despite all this, the stock has dropped more than 9% today.

The company’s outlook statements included an expected 45% fall in EBIT from the 6 months just passed for the 1st half of 2020. The significant fall will be driven by tightening steel spreads for the first half and falling volumes. It is important to note analysts were expecting a ~40% fall in EBIT for FY20 and BlueScope do see a reasonable 40/60 skew in earnings towards the second half. With FY20 consensus EBIT sitting at $803m and applying the 40/60 1H / 2H skew to those numbers, guidance now implies a number closer to $700m for the year, or a 12% miss versus current expectations.

It also seems like the selloff is being amplified by a headline grabbing $1b expansion of the North Star mill in the US which will add 850kt of capacity by 2023. The big CAPEX spend will hurt in the short term however it is an amount the balance sheet can handle even while the company continues to buy back stock and pay healthy dividends.

BlueScope (BSL) Chart

Shareholders will get a 14c full year dividend with income for FY19 in line with FY18. The company’s large cash balance is also being put to work in supporting the stock with buybacks currently in place. Despite all this, the stock has dropped more than 9% today.

The company’s outlook statements included an expected 45% fall in EBIT from the 6 months just passed for the 1st half of 2020. The significant fall will be driven by tightening steel spreads for the first half and falling volumes. It is important to note analysts were expecting a ~40% fall in EBIT for FY20 and BlueScope do see a reasonable 40/60 skew in earnings towards the second half. With FY20 consensus EBIT sitting at $803m and applying the 40/60 1H / 2H skew to those numbers, guidance now implies a number closer to $700m for the year, or a 12% miss versus current expectations.

It also seems like the selloff is being amplified by a headline grabbing $1b expansion of the North Star mill in the US which will add 850kt of capacity by 2023. The big CAPEX spend will hurt in the short term however it is an amount the balance sheet can handle even while the company continues to buy back stock and pay healthy dividends.

BlueScope (BSL) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook