Nickel supply issue causes a price surge

Stock

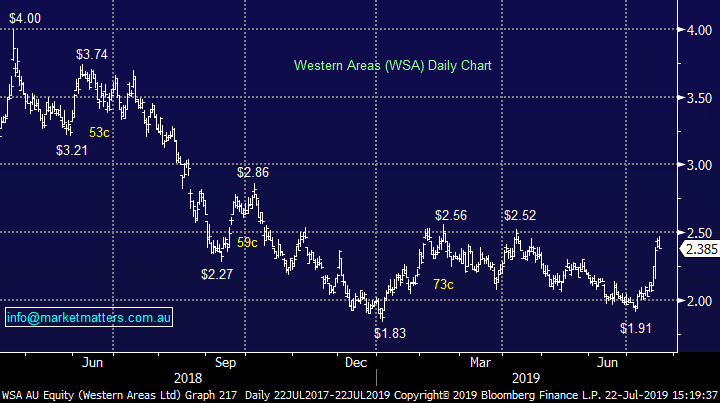

Western Areas (WSA) $2.40 as at 22/07/2019

Independence Group (IGO) $5.41 as at 22/07/2019

Event

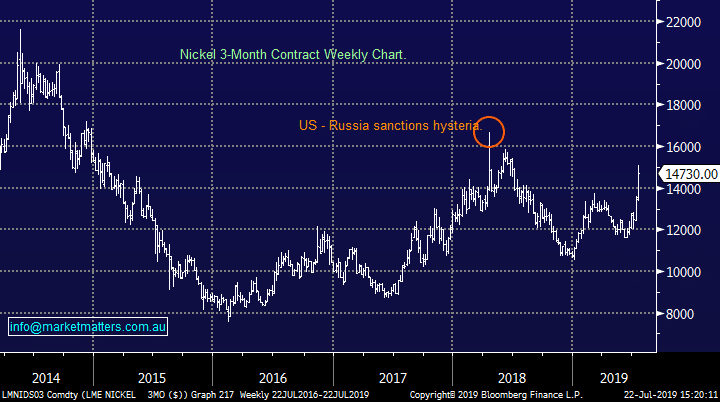

The past fortnight has seen a significant recovery in the nickel price which has become hard to ignore. Early in the month, nickel looked like it was teetering on the edge again after it slumped sub $US 5.50/lb, however it has since bounced back swiftly to crash through $US 6.50/lb and set a new 12 month high.

The move has helped local nickel names Independence Group (IGO) and Western Areas (WSA) trade higher to their own multi-month highs. Indonesia is playing a big part in the rally. One of the world’s biggest nickel ore exporters is currently experiencing severe flooding which has constrained the supply in the market. Stock piles fell to four-weeks on hand as a result of the disruptions, and has also shed light on the potential impact that an Indonesia export ban could have on the market.

Nickel Chart

The Indonesian Government currently plans to ban unprocessed nickel exports from 2022, forcing miners to export the value-added refined product. Currently only a small portion of miners are prepared for the ban, with much of the supply unlikely to have smelters in pace in time for the cut off.

Although the end date remains years away, it has helped the commodity higher in the short term and will potentially have a significant impact on earnings for IGO and WSA in the outer years. We have already seen how supply disruptions can impact a commodity through the iron ore spike this year – could nickel be next?

Western Areas (WSA) Chart

The Indonesian Government currently plans to ban unprocessed nickel exports from 2022, forcing miners to export the value-added refined product. Currently only a small portion of miners are prepared for the ban, with much of the supply unlikely to have smelters in pace in time for the cut off.

Although the end date remains years away, it has helped the commodity higher in the short term and will potentially have a significant impact on earnings for IGO and WSA in the outer years. We have already seen how supply disruptions can impact a commodity through the iron ore spike this year – could nickel be next?

Western Areas (WSA) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook