Calls for the week – US Markets, Iron ore & SIG

**This is an extract from the Market Matters Weekend Report from 14 July. Click here to get access to the full report and more

Chart of the week.

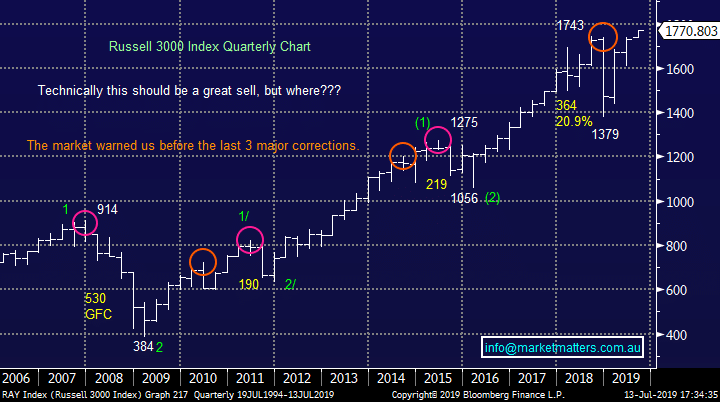

We preach at almost nauseam that subscribers should remain open-minded with markets and US equities are currently illustrating this point perfectly, simply consider the following 3 points:

1 – The broad based Russell 3000 has broken out to new all-time highs, while we feel a decent correction will unfold in 2019 / 2020 there are zero sell signals and another 7-8% upside is easy to envisage.

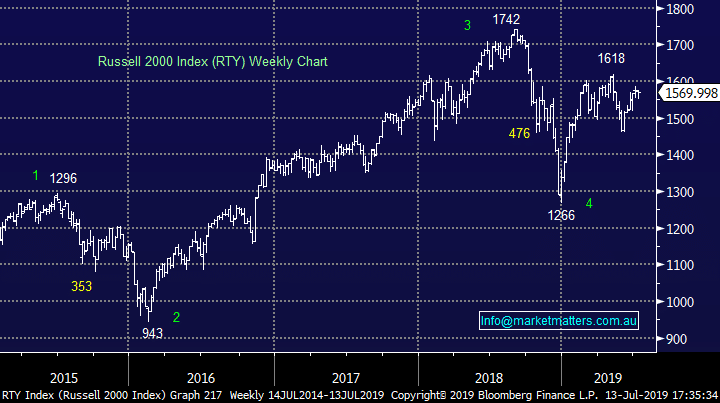

2 – The small cap Russell 2000 Index remains technically bullish targeting ~10% upside.

3 – The largely followed S&P500 and NASDAQ have achieved our target areas but have not yet generated any sell signals.

We may be concerned that a top is evolving in US stocks but they could easily run a lot higher first.

Russell 3000 Index Chart

Russell 2000 Index Chart

Russell 2000 Index Chart

Investment of the week.

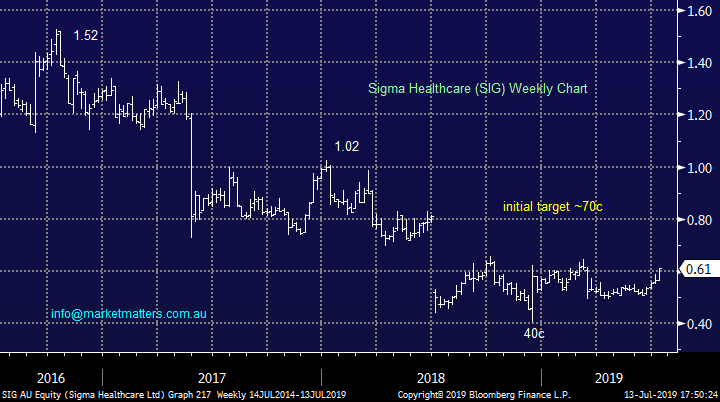

It’s a tough one this week after we’ve have mentioned a few stocks in our “buy bucket” moving forward but I’ve finally plumbed for Sigma Healthcare (SIG). The Australian business wholesales and distributes pharmaceutical products, the stock collapsed ~40% back in 2017 when it lost the Chemist Warehouse contract and has not really recovered since.

MM is bullish SIG with an initial target ~15% higher.

Sigma Healthcare (SIG) Chart

Investment of the week.

It’s a tough one this week after we’ve have mentioned a few stocks in our “buy bucket” moving forward but I’ve finally plumbed for Sigma Healthcare (SIG). The Australian business wholesales and distributes pharmaceutical products, the stock collapsed ~40% back in 2017 when it lost the Chemist Warehouse contract and has not really recovered since.

MM is bullish SIG with an initial target ~15% higher.

Sigma Healthcare (SIG) Chart

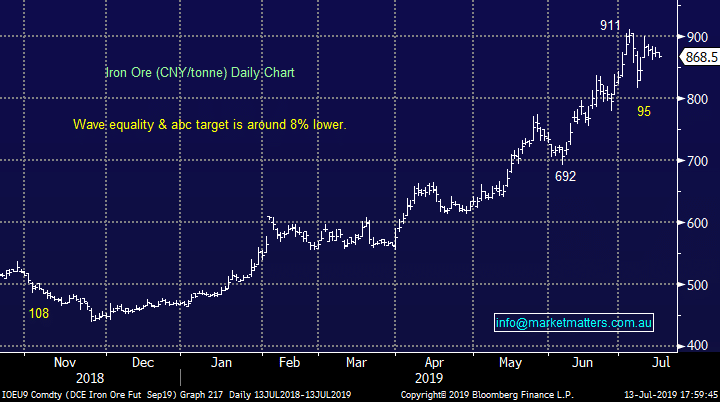

Trade of the week.

We remain bullish iron ore medium term but we believe it will be a volatile ride hence preparation for major swings is important. Technically we can see the bulk commodity testing 800 on the downside, a pullback of this degree we believe will provide a buying opportunity in the related sector names, especially leveraged player Fortescue (FMG).

MM likes FMG around 10% lower i.e. under $8.

Iron Ore (CNY/tonne) Chart

Trade of the week.

We remain bullish iron ore medium term but we believe it will be a volatile ride hence preparation for major swings is important. Technically we can see the bulk commodity testing 800 on the downside, a pullback of this degree we believe will provide a buying opportunity in the related sector names, especially leveraged player Fortescue (FMG).

MM likes FMG around 10% lower i.e. under $8.

Iron Ore (CNY/tonne) Chart