Metcash (MTS) full year results disappoint

Stock

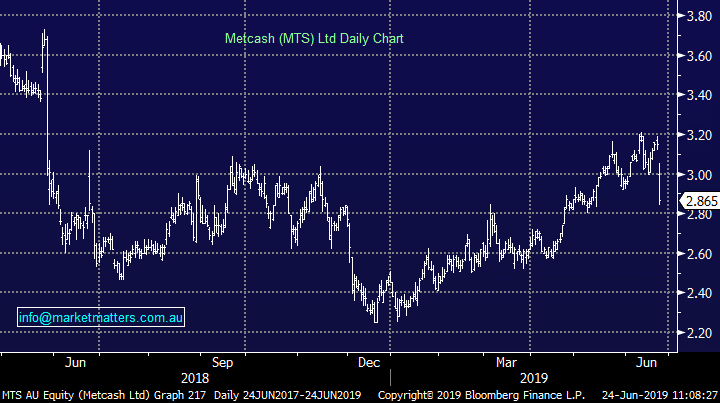

Metcash (MTS) $2.86 as at 24/06/2019

Event

The grocery and hardware wholesaler is trading lower this morning following the release of their full year results for the 12 months to April. Despite swinging back into a profit on a statutory basis, the result has missed expectations, and the market is selling the stock on some softer underlying metrics.

For the group, EBIT came in at $330m, slightly below last year’s figure and just about in line with expectations. On a segment level, hardware was the standout adding 17%, while food continues to struggle, falling 3% at the EBIT line. Underlying NPAT fell 3% to $210m where expectations were looking for a number in line with last year’s.

The outlook for Metcash is a little worse than many had hoped. Key to the Metcash plan is continued cost out initiatives but the company seems to be hitting some roadblocks on the way, noting that benefits from repricing “onerous lease obligations” is expected to be less than anticipated to the food category. In the hardware business, costs savings aren’t expected to offset a slowdown in construction activity. Upside can be seen in the liquor business with continued ‘premiumisation’ of the market and the Porters brand rollout to help, however this is now the smallest contributor to EBIT for Metcash.

Metcash (MTS) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook