Woolworths (WOW) loses the first quarter battle to Coles

Stock

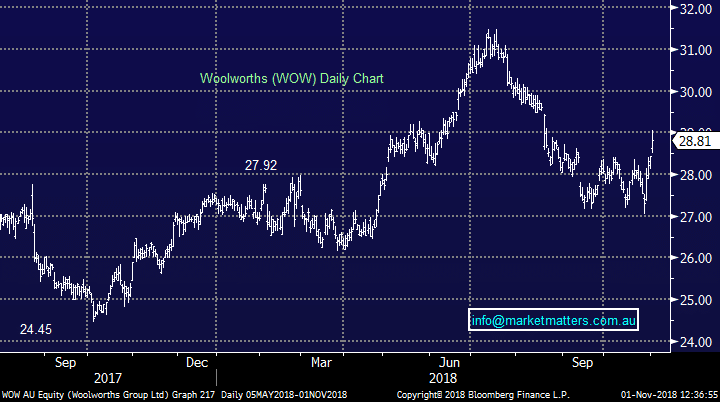

Woolworths (WOW) $28.85 as at 01/11/2018

Event

The supermarket group is tracking slightly higher despite posting its worst quarter of like for like (LFL) sales growth in two years, impacted by the Cole’s little shop promo and plastic bag saga. The result was more or less as expected, with some positives surprises albeit off a low base.

Food – makes up about 70% of the groups EBIT – saw LFL sales growth of +1.8%, over average prices excluding tobacco & fruit/veg fell -2.9% as they discounting was used to drive some growth. Online sales grew from 2.7% to 3.3% of food sales.

Liquor - ~20% of the EBIT – managed LFL growth at 1.7% for the quarter, slightly below the markets expectations

Big W – drags EBIT -9% - one positive in the announcement, Big W saw LFL grow 2.2% as signs the big (W) headache is easing.For only the second time in the last five years, Big W had back to back positive LFL growth

The group is also looking to divest its petrol assets which saw 8.1% growth over the quarter. A decision is yet to be made as whether the business will be sold or de-merged through an IPO.

Woolworths (WOW) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook