Healthscope (HSO) receive another takeover offer

Stock

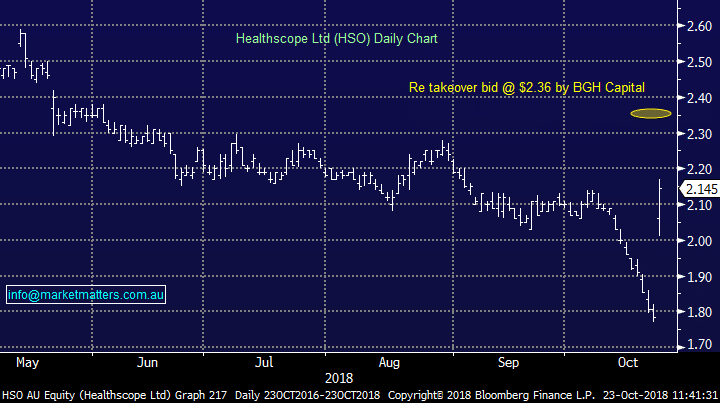

Healthscope (HSO) $2.15 as at 23/10/2018

Event

Another takeover offer has come through for the hospital operator Healthscope with the stock trading sharply higher in trade today. The BGH - Australian Super consortium lobbed an all cash offer at $2.36 per share today with similar conditions to their rejected advance back in May, although some additional caveats in this current announcement around meeting earnings expectations, debt levels and the requirement that no recurring cash costs were classified as “non-operating expenses’ in the FY18 result. These caveats, combined with the poor recent price action in HSO stock makes us nervous that in fact, HSO earnings may have deteriorated impacting debt levels + there is obvious concern from the bidders around HSO accounting policies.

The new offer is 5.6% below the recent Bookfield offer of $2.50, but at the same price as BGH’s original offer of $2.36. At the time, Healthscope said both offers materially undervalued the company. The takeover target is in demand from long term value investors with the property portfolio alongside leverage to the aging Australian population is certainly attractive from an investment stand point. In the shorter term, HSO has struggled to grow earnings recently amid weakness in private health cover. Healthscope recently sold their Asian pathology unit which we wrote about here

Healthscope (HSO) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook