Coles a standout in Wesfarmers first quarter sales

Stock

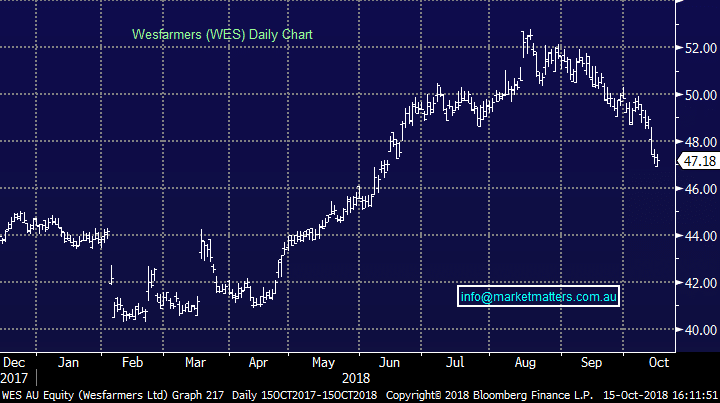

Wesfarmers (WES) $47.18 as at 15/10/2018

Event

The conglomerate released an impressive retail sales report for the first quarter of their financial year today, driven by solid growth out of Coles, as well as growth out of their convenience and liquor segments. Coles life-for-like (LFL) sales grew a huge +5.1% thanks to the ‘Little Shop’ promotion, as well as the delay in the plastic bag ban (Coles ban begun a fortnight after Woolworths). Also notable in the result was as price inflation not seen since 2017, while Wesfarmers also benefitted from an increase in transaction growth and basket size as Coles gains ground on Woolworths in these areas. Coles online also helped drive the sales growth, which jumped 30% for the quarter.

Liquor added 1.3% on a LFL basis, which was lower than the previous quarter, while convenience was a strong (+3.4%) despite a significant decline in petrol (-15.9%) suggesting the work Coles express have done in store is having an impact, with the company pointing to food-to-go offerings as key to the growth.

Wesfarmers (WES) Chart

Market Matters Take/Outlook

Despite the solid result, shares didn’t move too far today, falling -0.32%. Wesfarmers will become a different beast once the demerger of Coles is completed. Much of their performance will be driven by Bunnings which would become around 50% of the new entity’s earnings. We don’t have any interest in the current Wesfarmers, seeing more competition in the supermarket space as an issue, however the post demerger company would be compelling if we see strength in the housing market.

Market Matters Take/Outlook

Despite the solid result, shares didn’t move too far today, falling -0.32%. Wesfarmers will become a different beast once the demerger of Coles is completed. Much of their performance will be driven by Bunnings which would become around 50% of the new entity’s earnings. We don’t have any interest in the current Wesfarmers, seeing more competition in the supermarket space as an issue, however the post demerger company would be compelling if we see strength in the housing market.