Clydesdale – Virgin Money deal jumps final hurdle

Stock

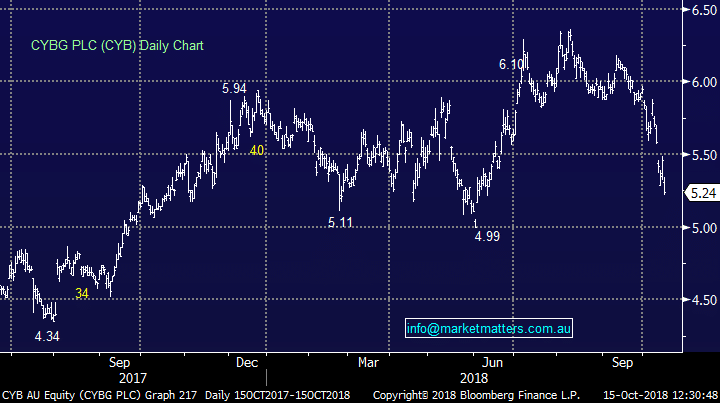

CYBG Plc (CYB) $5.24 as at 15/10/2018

Event

In more of a formality than a milestone, the UK court has given its approval for the CYB takeover of Virgin Money that was announced 4 months ago with Virgin Money shares to be cancelled and new CYB shares issued before UK trade opens tonight. The deal sees a largely online & personal focused CYB join forces with a business & branch focused Virgin Money. CYB has been soft of late, falling $1.14 / -17.9% since early August, a hefty decline and one that’s certainly caught our eye. The fall, in our view, relates to the ongoing BREXIT problems, as well as the proposal to tax foreign buyers on multiple properties which creates a head wind for potential loan growth.

Clydesdale (CYB) Chart

Market Matters Take/Outlook

For the first time in a long time, CYB is trading below net tangible asset (NTA) and is screening extremely cheap. To go with this, the Virgin money deal will add further upside to the cost out story which the bank has already begun, with synergies set to increase the benefits of the takeover. Another benefit to the takeover will be a significant increase to the bank’s capital position, with the tier 1 ratio to grow to 16% as the risk weighted assets fall. This could free up £700m paving the way for special dividends to boost shareholder returns.

Market Matters Take/Outlook

For the first time in a long time, CYB is trading below net tangible asset (NTA) and is screening extremely cheap. To go with this, the Virgin money deal will add further upside to the cost out story which the bank has already begun, with synergies set to increase the benefits of the takeover. Another benefit to the takeover will be a significant increase to the bank’s capital position, with the tier 1 ratio to grow to 16% as the risk weighted assets fall. This could free up £700m paving the way for special dividends to boost shareholder returns.