TPG (ASX:TPM) shows growth in tough conditions for FY18 result

Stock

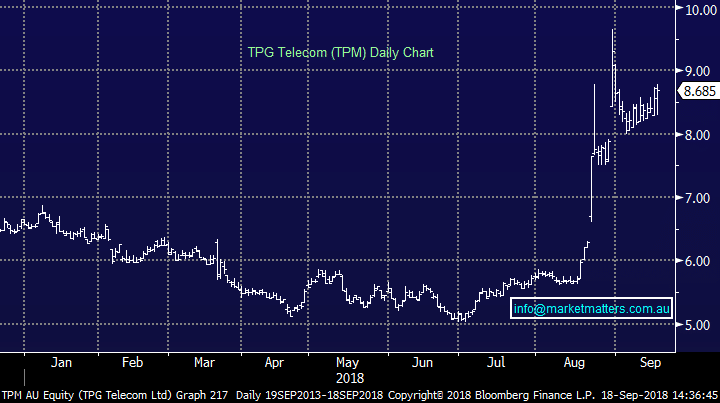

TPG Telecom (ASX:TPM) $8.69 as at 18/09/2018Event

TPG’s full year result hit the boards pre-market and while the numbers looked inline to a slight beat, the market sold it off initially largely on the downbeat commentary provided by the company, however the stock has rallied back from early falls of ~-4.8% to now trade around flat for the day. The telco has been facing the same problem as many others in the crowded Australian broadband market – margin pressure as customers move onto the nbn – however they still managed nearly 1% EBITDA growth over the year, while also printing well above the twice upgraded FY18 guidance. They gave guidance of FY19 EBITDA of $800M-820M, above the market’s current expectations of $800m. The next catalyst will likely be the progress of the merger with Vodafone, with the combined business tackling broadband, fixed and mobile services. The deal still has a few hurdles to jump through, the biggest being the ACCC approval, however it does signify the potential consolidation of telcos.

TPG Telecom (ASX:TPM) Chart

The next catalyst will likely be the progress of the merger with Vodafone, with the combined business tackling broadband, fixed and mobile services. The deal still has a few hurdles to jump through, the biggest being the ACCC approval, however it does signify the potential consolidation of telcos.

TPG Telecom (ASX:TPM) Chart