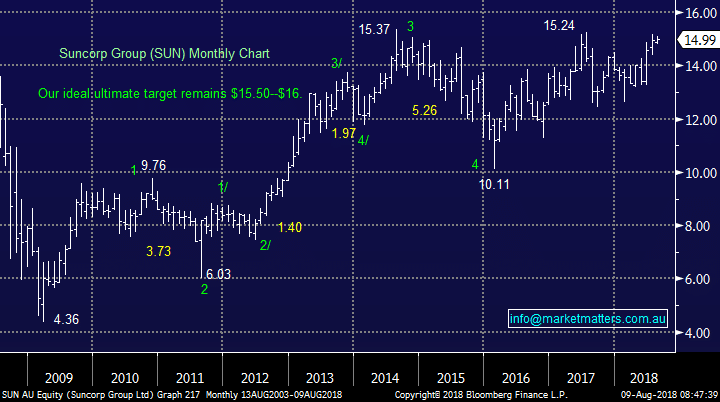

Suncorp (SUN) – A new dawn

Stock

Suncorp (SUN) $15.76 as at 9/08/2018Event

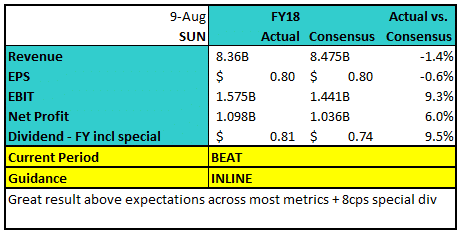

Suncorp (SUN) have reported their FY 2018 results this morning with a number of clear takeaways. This was a stronger result than expected pretty much across the board with a 5% beat in terms of cash NPAT, an 8cps special dividend coming as a surprise and the sale of their Life Insurance Business with $600m (~46cps) going back to shareholders on completion, however the main takeaway for us is acknowledgment that momentum in the business thanks to the ongoing business improvement program is strong while costs are being well managed = strong future leverage.

What we liked?

Six months ago, SUN hung their hat on a strong second half, they backed themselves in from a long way out and it seems they’re on track to deliver on most metrics. The business improvement program is working with SUN exceeding their net benefits target of $30m for the year while they’ve addressed the Life Insurance issue by flicking the business for $725m with $600m going back to shareholders on completion. There was pressure on the CEO Michael Cameron to start delivering on a range of promises and todays result should go a long way to satisfy the markets concerns.What we didn’t?

The bears will concentrate on the softer than expected result in SUN’s banking division and there is some substance to those calls. Banking income fell by 4% from 1H18 to 2H18 and was flat from FY17 to FY18, however as shown yesterday through CBA’s result, times are fairly tough in this market. Net Interest Margins (NIM) came in at 1.84% versus expectations for 1.86% while the banks dad debt charge was $27m or 5bp. Tier 1 capital was in line at 9.1%. So, an okay set of numbers from the banking division however the insurance result is what had driven the beat here. Suncorp (SUN) – targets $16 on the upside