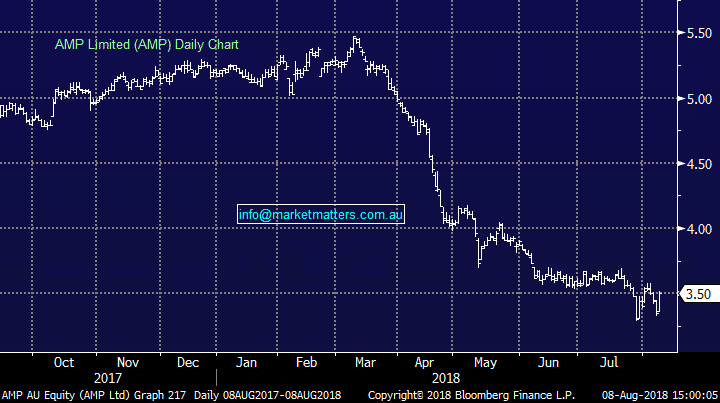

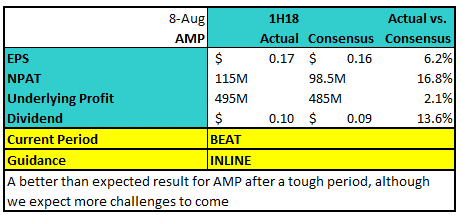

AMP (AMP) – A better result than feared

Stock

AMP (AMP) $3.50 as 08/08/2018Event

This morning AMP reported their first half results that proved to be better than the markets downbeat expectations, in terms of the underlying earnings, dividend and even at the profit line, albeit, it was down substantially on the pcp. Obviously AMP has some major structural headwinds playing out, and the reputation damage caused by the Royal Commission is hard to quantify, the results today gave some insight into the costs so far. The underlying profit at $495m was ahead of forecasts of $485m however there were significant costs that impacted the net profit line which came in at $115m. These included $312m in advice remediation and related costs, $13m of costs associated with the Royal Commission and other bits and pieces. AMP had previously guided to a profit of about $100m and todays result was better than that, however there remains many challenges on the horizon for the iconic Australian wealth business, including an ongoing reduction in adviser numbers with adviser headcount down by 7% over the year and net cash outflows - nearly $1B in cash outflows in the first half.

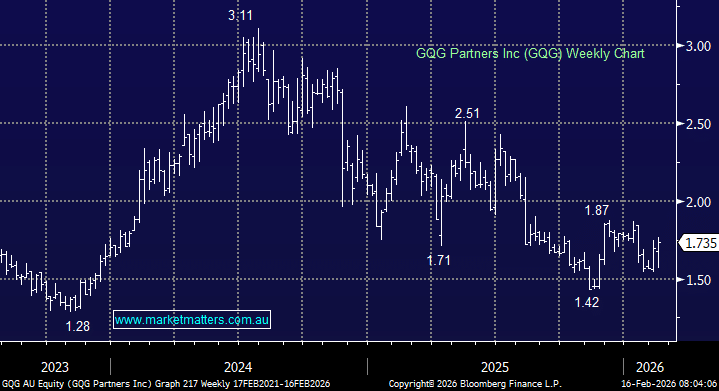

AMP (AMP) Chart

AMP had previously guided to a profit of about $100m and todays result was better than that, however there remains many challenges on the horizon for the iconic Australian wealth business, including an ongoing reduction in adviser numbers with adviser headcount down by 7% over the year and net cash outflows - nearly $1B in cash outflows in the first half.

AMP (AMP) Chart