Clydesdale supported following quarterly

Stock

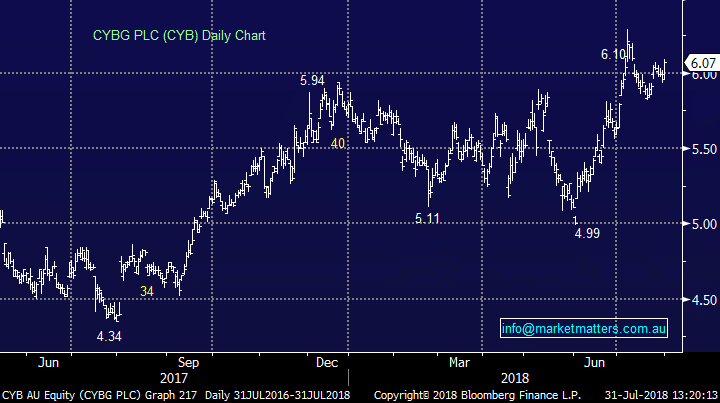

Clydesdale (CYB) $6.07 as at 31/07/2018

Event

The UK bank provided investors with a 3rd quarter update late yesterday which came with no surprises, although was somewhat light on detail regarding the progress of the Virgin money acquisition. Mortgage growth was at an annualised rate of 3.8%, which is expected to drag the full year growth to the lower end of the 4-6% guidance. This was offset somewhat by SME lending which showed healthy growth of 5% annualised with resilience expected into the fourth quarter. Guidance was maintained across the board – we do see some risk to NIM however as CYB target 220bps, they have been running at ~218bps for the year.

CYB did say their ongoing PPI complaints remain elevated, although this is in line with expectations and are comfortable with current provisions for claims – some risk to their forecasts here as they expect a slowdown in claims before the deadline. Human mentality would suggest the potential for a spike in complaints before the August 2019 deadline.

Clydesdale (CYB) Chart

Market Matters Take/Outlook

The stock has bounced somewhat on the news, but still remains pinned near the $6 area where we sold not too long ago. We are keeping an eye on CYB, seeing the cost out program, Virgin money acquisition and UK interest rates as catalysts to see the stock higher, preferring to buy back into a correction.

Market Matters Take/Outlook

The stock has bounced somewhat on the news, but still remains pinned near the $6 area where we sold not too long ago. We are keeping an eye on CYB, seeing the cost out program, Virgin money acquisition and UK interest rates as catalysts to see the stock higher, preferring to buy back into a correction.