Prices help Iluka's second quarter

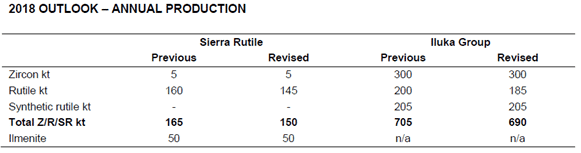

Stock Iluka (ILU) $11.20 as at 24/07/2018 Event Mineral Sands miner Iluka released their 2Q production numbers: Actual production was strong for the quarter with price realisation another bright spot. ILU is producing strong free cash flow given a work down in stockpiles and that’s helping them pay down debt. The negative part of the update was guidance which missed by ~2%. Key points…

- Sales revenue up strongly – 1H revenue was up ~21% YoY despite lower sales volume (3%) and adverse currency rate (2.4%) suggesting that underlying commodity price trend was favourable and the expectation is for further gains in 2H.

- Selling price trend still up – Average selling prices (ASP) increased in 1H;

- zircon price (excluding concentrate) up 47% from first half 2017

- first half rutile price up 20% from first half 2017, second half 2018 rutile price increase of 14%

- WC unwind still .. Sales volumes continue to exceed production in line with the working capital unwind of the company’s large (although now declining sharply) inventory position. YTD sales (Zircon + rutile + synthetic rutile) of 438kt was well ahead of production at 351kt – similar trend in JQ as well.

- Cash position higher, almost back to net cash. Net debt reduced further to $34 million, from $183 million at 31 December 2017, reflecting strong free cash flow in the first half of $226 million (annualized FCF yield of ~10%) and payment of $69 million for the 2017 final dividend. This level of FCF is well ahead of our expectations.

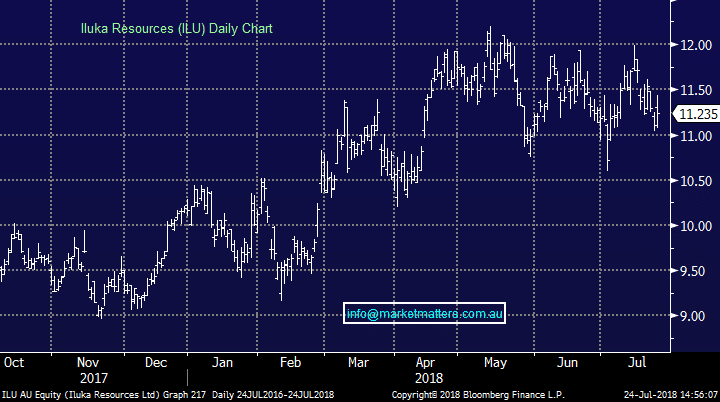

Iluka (ILU) Chart

Iluka (ILU) Chart

Market Matters Take/Outlook

The outlook for Iluka ...

Market Matters Take/Outlook

The outlook for Iluka ...