BHP Quarterly Exceeds Expectations | BHP Report

Stock

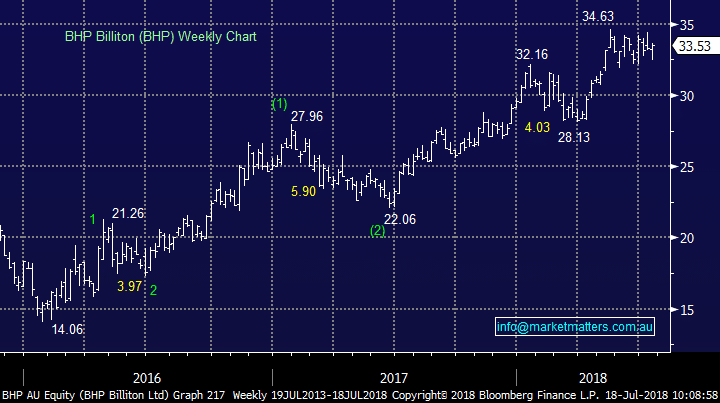

BHP Billiton (BHP) $33.53 as at 18/07/2018Event

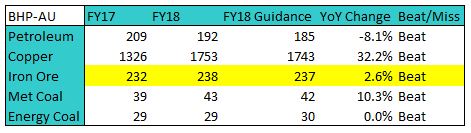

BHP today released an impressive set of FY18 production results, beating guidance and market expectations across the board, along with setting new records for annual iron ore, met coal and copper production. Along with the figures, BHP gave production guidance into FY19, expecting higher iron ore & coal, while a small fall in copper production is expected. Other things to note in the release was a forecast for higher exploration costs into the second half of the year, while a mention was given to the US Shale assets sales with the company having this to say – “The exit process for Onshore US is progressing to plan. Bids have been received and we aim to announce one or more transactions within the coming months, targeting completion of any transactions by the end of the 2018 calendar year.” It sounds like multiple buyers are still in the hunt, potentially forcing the price higher and increasing the returns back to shareholders. It is widely understood that any proceeds will return straight to shareholders in the form of buy-backs and special dividends. BHP Billiton (BHP) Chart

BHP Billiton (BHP) Chart