Asaleo Care's (AHY) first half result – the market doesn't care

Stock

Asaleo Care (AHY) $0.84 as at 17/07/2018Event

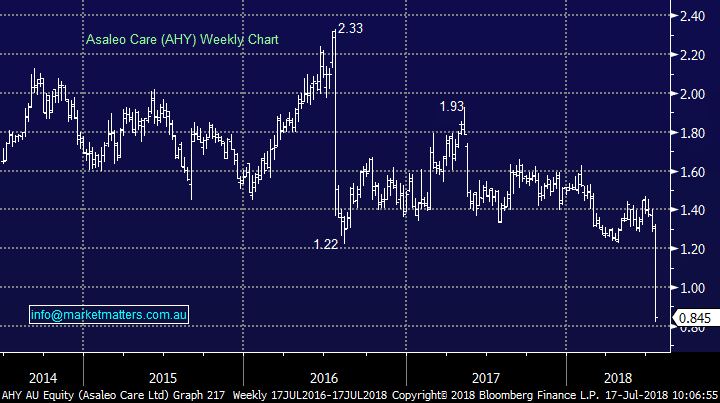

The personal hygiene company today pre-released a disappointing first half result and lowered expectations for the full year, causing ~30% of the company’s value to be wiped from the market. Asaleo saw costs rise and sales fall in the half, and the headwinds are likely to continue throughout the year. The company, which owns brands such as Sorbent and Libra, posted an underlying first half EBITDA of $46.3 mil, 24% below last year’s first half. Guidance for the year has been reduced ~29%, down from $113-$119 mil, to $80-$85 mil. Asaleo have raised prices across most products, and concedes sales volumes will fall as competitors have so far failed to follow suit. Asaleo Care (AHY) Chart