Over the years at MM we have regarded the resources sector as a trading / short-term vehicle for 2 main reasons – the lack of yield and the lack of control over commodity prices which by definition dictates their underlying profitability. However, the yield side of the equation has made a total 360 degree turn with BHP yielding 3.7% and Alumina (AWC) 6.25% both fully franked, hence making the sector more attractive if we time our entry levels correctly i.e. we are buyers of weakness, not strength.

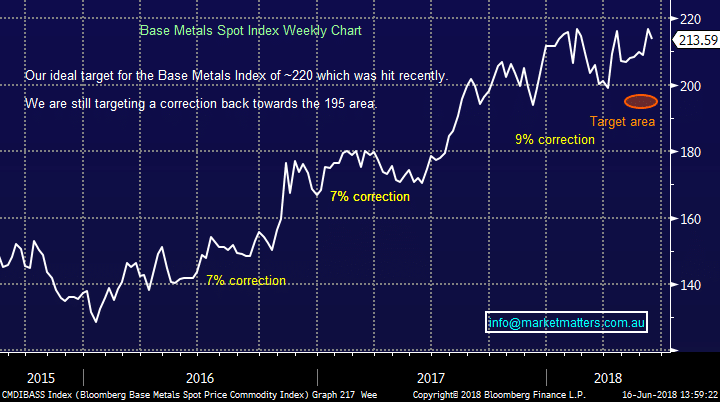

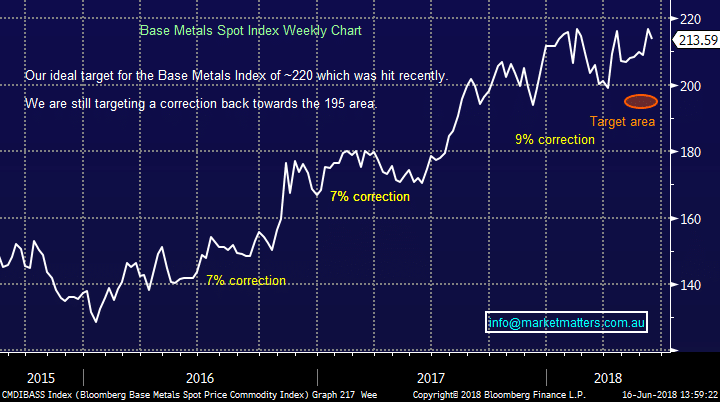

As we have been saying for a number of weeks from a simple risk / reward perspective we believe the most likely next 10% move by base metals is down. However we believe this would be no reason for hysteria, more likely an excellent shorter term buying opportunity and in context it would only represent a small retracement of the gains since early 2016.

Importantly it remains essential to have a plan if further sector weakness does unfold.

Bloomberg Base Metals Spot Index Chart

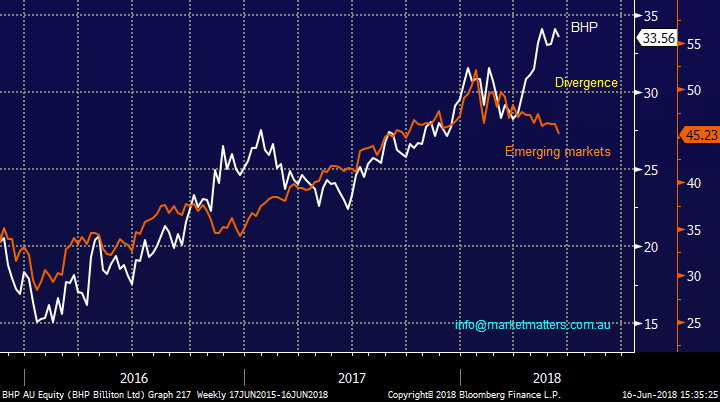

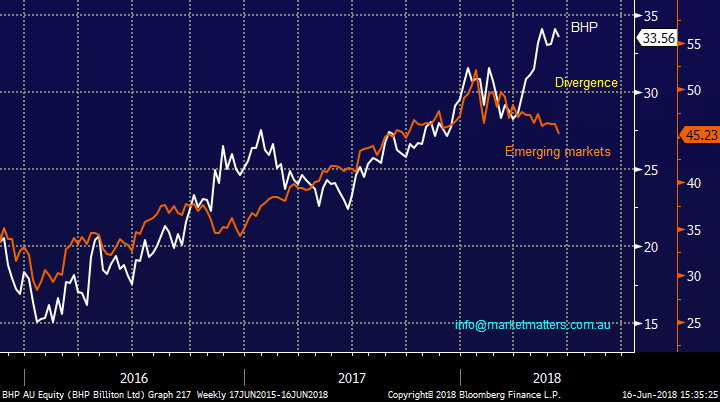

Sector goliath BHP has looked after us nicely in recent times and while we have no real exposure to the sector the obvious question is where do we try and re-enter. Over the years one thing I have noticed is logic and the market rarely travel together over the short-term e.g. BHP has ignored major weakness in both crude oil and the emerging markets (EEM) over the last few weeks but Friday nights sharp 84c drop by BHP in the US gives us a sniff that it might just be time for some catch up.

We took a healthy profit in BHP a month ago around $34, since then the stock has neither made us feel silly or given us the opportunity to re-enter cheaply.

Ideally we will be able to start accumulating a position in the “big Australian” back under $30, exactly where BHP was when oil and the EEM were trading around today’s levels.

BHP v Emerging Markets Chart

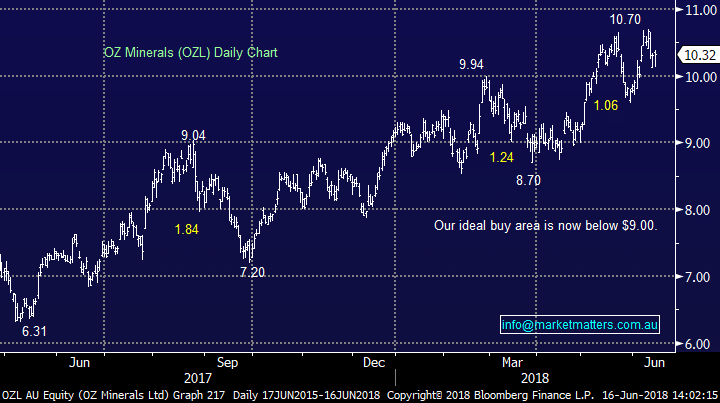

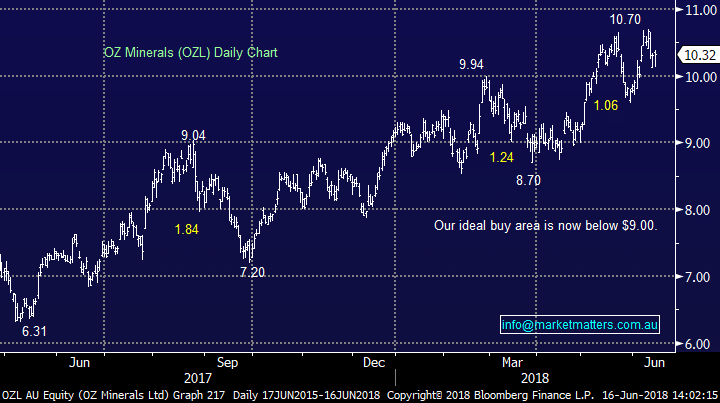

OZ Minerals (OZL) is likely to struggle on Monday with both gold and copper down over 2%. Investors in OZL must acknowledge the volatility in the stock which regularly experiences 10-20% corrections.

- We may have interest around $9.50 but will definitely do so closer to $9.

OZ Minerals (OZL) Chart

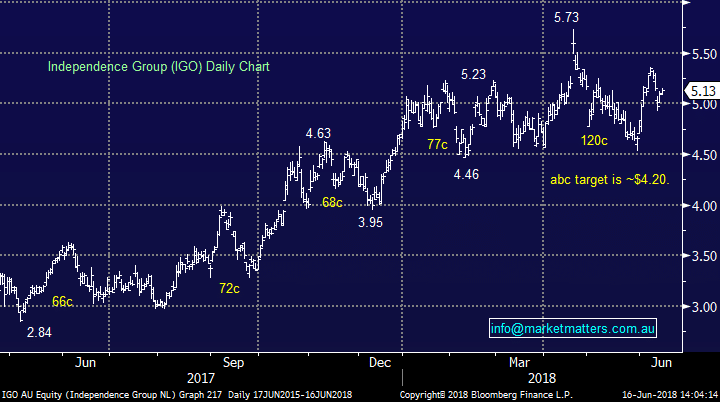

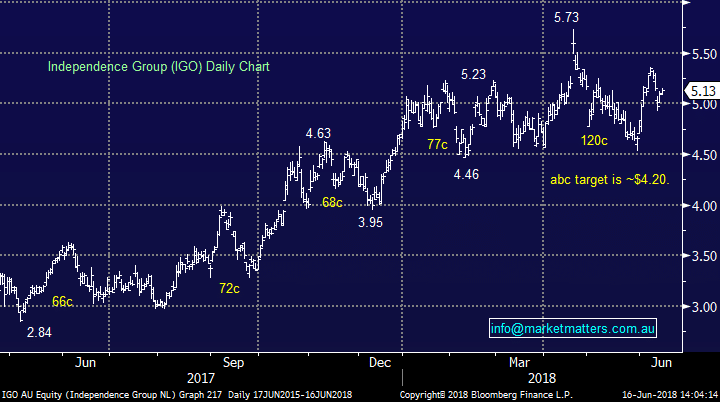

We exited our Independence Group (IGO) last week just above $5 for reasons outlined at the time. The stock should come under pressure on Monday with weakness in both nickel and gold, the companies two sources of revenue. The stock has already corrected $1.20 / 17.8% in 2018 and we believe a repeat performance is a strong possibility.

- We are neutral IGO at present but would certainly be interested buyers around $4.25.

Independence Group (IGO) Chart

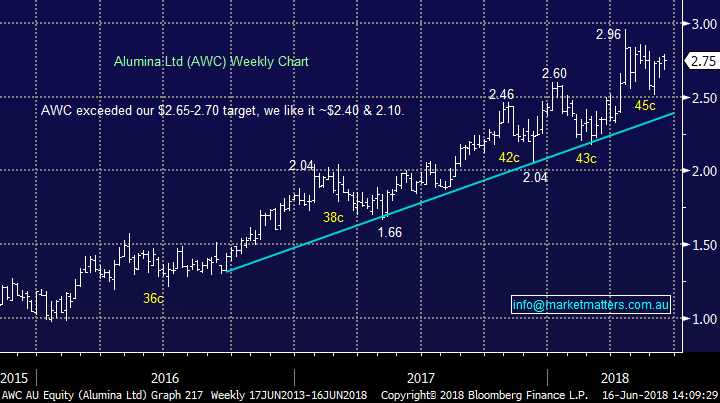

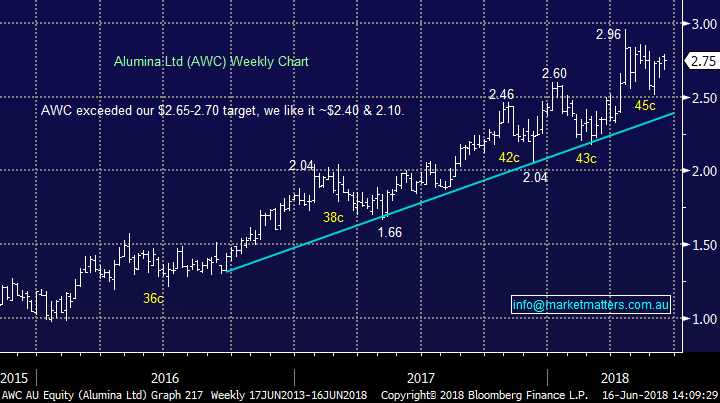

Lastly looking at the high yielding aluminium play Alumina Ltd (AWC). From a technical perspective the stocks not as clear as the previous 3 but it’s cheap from a valuation perspective and its dividend is certainly attractive.

- We like AWC back towards $2.40, and especially $2.10.

Alumina (AWC) Chart

Sector goliath BHP has looked after us nicely in recent times and while we have no real exposure to the sector the obvious question is where do we try and re-enter. Over the years one thing I have noticed is logic and the market rarely travel together over the short-term e.g. BHP has ignored major weakness in both crude oil and the emerging markets (EEM) over the last few weeks but Friday nights sharp 84c drop by BHP in the US gives us a sniff that it might just be time for some catch up.

We took a healthy profit in BHP a month ago around $34, since then the stock has neither made us feel silly or given us the opportunity to re-enter cheaply.

Ideally we will be able to start accumulating a position in the “big Australian” back under $30, exactly where BHP was when oil and the EEM were trading around today’s levels.

BHP v Emerging Markets Chart

Sector goliath BHP has looked after us nicely in recent times and while we have no real exposure to the sector the obvious question is where do we try and re-enter. Over the years one thing I have noticed is logic and the market rarely travel together over the short-term e.g. BHP has ignored major weakness in both crude oil and the emerging markets (EEM) over the last few weeks but Friday nights sharp 84c drop by BHP in the US gives us a sniff that it might just be time for some catch up.

We took a healthy profit in BHP a month ago around $34, since then the stock has neither made us feel silly or given us the opportunity to re-enter cheaply.

Ideally we will be able to start accumulating a position in the “big Australian” back under $30, exactly where BHP was when oil and the EEM were trading around today’s levels.

BHP v Emerging Markets Chart

OZ Minerals (OZL) is likely to struggle on Monday with both gold and copper down over 2%. Investors in OZL must acknowledge the volatility in the stock which regularly experiences 10-20% corrections.

OZ Minerals (OZL) is likely to struggle on Monday with both gold and copper down over 2%. Investors in OZL must acknowledge the volatility in the stock which regularly experiences 10-20% corrections.

We exited our Independence Group (IGO) last week just above $5 for reasons outlined at the time. The stock should come under pressure on Monday with weakness in both nickel and gold, the companies two sources of revenue. The stock has already corrected $1.20 / 17.8% in 2018 and we believe a repeat performance is a strong possibility.

We exited our Independence Group (IGO) last week just above $5 for reasons outlined at the time. The stock should come under pressure on Monday with weakness in both nickel and gold, the companies two sources of revenue. The stock has already corrected $1.20 / 17.8% in 2018 and we believe a repeat performance is a strong possibility.

Lastly looking at the high yielding aluminium play Alumina Ltd (AWC). From a technical perspective the stocks not as clear as the previous 3 but it’s cheap from a valuation perspective and its dividend is certainly attractive.

Lastly looking at the high yielding aluminium play Alumina Ltd (AWC). From a technical perspective the stocks not as clear as the previous 3 but it’s cheap from a valuation perspective and its dividend is certainly attractive.