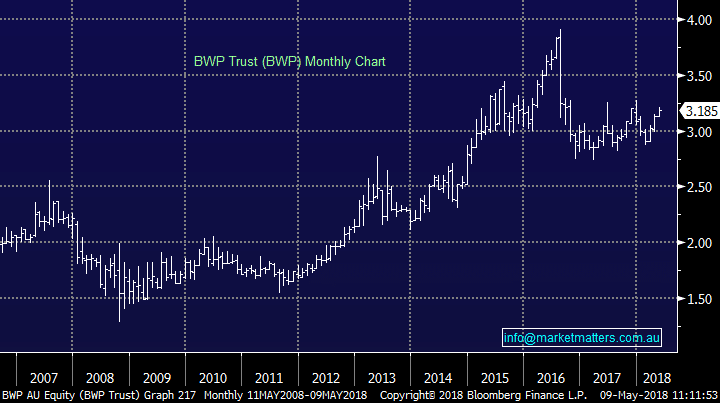

BWP Trust – Overvalued Yield Stocks

Stock

BWP Trust (BWP) $3.18 as at 09/05/2018 - expected yield of 5.57% unfrankedEvent

April was a good month for property stocks, with the sector outperforming the strong move in the broader market (+4.5% vs. +3.9%) even though global interest rates also tracked higher through the period – the US 10 year yield cracking 3%. Higher rates are generally a headwind for property prices and therefore an impediment to property stocks. BWP manages commercial property – has about 80 investments spread geographically around Australia with Bunnings Warehouses one of the main tenants (but they also have others). This is a very well run property company with a well performing primary tenant. That said, it’s expensive trading at an 11% premium to its NTA which sits at $2.82. While the sector collectively trades at a 21% premium to NTA, this is skewed by companies that have funds management businesses and / or other areas of earnings. BWP does not, and in our view the stock screen ‘expensive’ relative to other sector players – Vicinity (VCX) for instance which trades at a -17% discount to NTA .Market Matters Take/Outlook

We are negative BWP at current levels targeting a move to $2.50 i.e ~ 20% lower BWP Trust Chart