Eclipx (ECX) – now on our radar

Stock

Eclipx Group (ECX) $3.41 as at 23/05/2018

Event

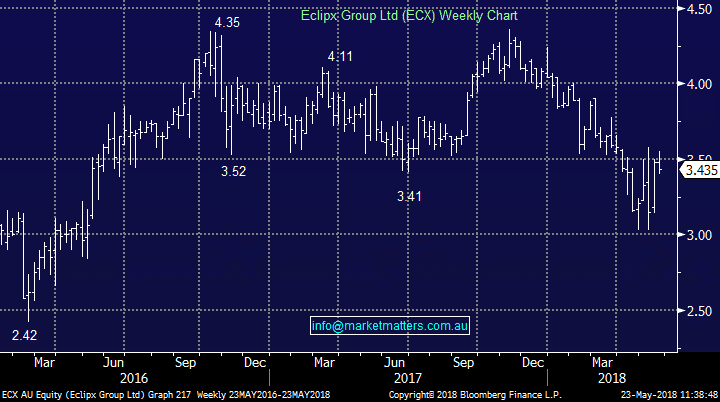

Eclipx is a $1bn vehicle leasing, fleet management business which also has a financial services division to support these operations. In addition to this core business, they have online car auctions (GraysOnline) and supply vehicles to not-at-fault drivers involved in an accident through their Right2Drive brand – both of these businesses were acquired in the last 18 months. The corporate fleet leasing in the main stay of earnings (about 60%) and is a mature operation growing at low single digits. The other parts provide the opportunity for earnings growth with the company recently re-affirming guidance for 10-12% earnings per share growth in the financial year to September 2018. As can be seen in the chart below, the stock has been weak in recent times, most likely due to the disappointing result from one of its competitors in February (SGF).

Australian Super has recently come on the register of ECX with a ~5% holding, and with the stock on a forward PE of 12.2x and an expected yield of around 5% fully franked plus a reasonable runway for earnings growth, this looks an attractive candidate for the MM Income Portfolio.

The near term catalyst for the share price to start moving is more difficult to find. Simply, it could be evidence that the companies guidance is on track, given the market has more bearish assumptions built into forecasts. They have guided to a second half skew in earnings which is not ideal, however it fits with the seasonality of the business, particularly GraysOnline.

Market Matters Take/Outlook

We are bullish ECX particularly if it can push up through recent highs above ~$3.60 which would target ~$4.25

Eclipx (ECX) Chart