Subscribers questions (RIO, OZL, WBC, CBA, FMG, COH)

Morning all, I hope everybody had a relaxing and safe Easter, while these unprecedented times continue at least one compensation is many of us are getting time to “smell the roses” with our families. Overnight France extended their lockdown by another month which illustrates to me the path back to normality is likely to be slow and steady, Australia has performed admirably on a relative basis to-date but the good work could be undone way if we relax the lockdown & social distancing laws without enough consideration of secondary breakouts aka several developed countries in Asia.

MM was going to deliver our Easter Report this morning but because we finished it slightly early and the S&P500 futures were swinging wildly yesterday we felt it would be more useful for subscribers if we delivered it on Easter Monday and followed up this morning with a very small missive reflecting on overnight moves and answering a couple of questions we’ve received over the last few days.

We remain positive equities in the months ahead believing the major unknowns from COVID-19 are behind us although the path to economic recovery is undoubtedly going to take a few twists and turns hence we foresee rotation by the ASX200 with an upside bias until further notice i.e. buy weakness and sell strength from an index perspective.

MM is in “Buy Mode” with a preference to the quality end of town.

ASX200 Index Chart

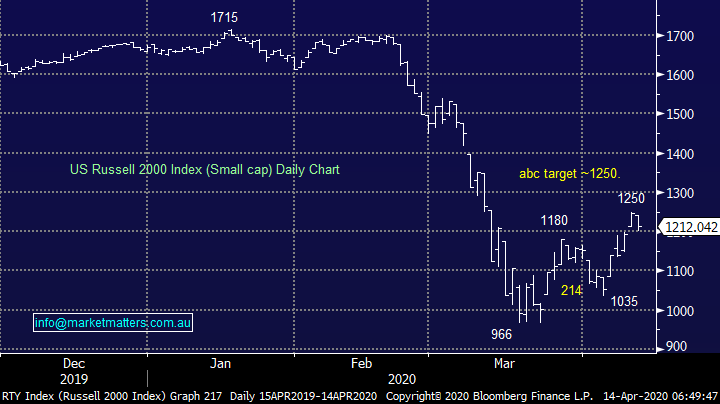

At a quick glance of the overseas moves last night it’s easy to feel a little dejected with the Dow falling over 300-points however the tech based NASDAQ rallied over 1%. At the smaller end of town the small cap Russell 2000 declined by almost 2% threatening to generate technical sell signals in the process – overall a mixed picture on the performance front. We can easily envisage the smaller end of town plumbing fresh 2020 lows while the “higher quality” stocks like Apple and Microsoft remain strong – similar to MM’s general view for stocks in 2020.

MM remains bullish US stocks but we are neutral in the very short-term ahead of earnings which start this week.

US NASDAQ Index Chart

US Russell 2000 Index Chart

As I said earlier I have briefly answered a handful of questions this morning which I hope prove informative to subscribers.

We’ve also had the following pieces of news out this morning that are relevant. QBE has entered a trading halt to raise capital. It was always likely to raise and this confirms it. The AFR also reporting this morning that Challenger Group (CGF) may also be about to tap the market. Clearly there are going to be a raft of equity raisings in the coming weeks.

Westpac (WBC) has provided a trading update this morning and outlined additional provisioning of $1.4bn, mainly resulting from AUSTRAC, plus some other bits and pieces - this is not provisioning for COVID-19. With this + expected provisioning from CV-19 there is a very good chance that Westpac (WBC) does not pay an interim dividend given tier 1 capital would be circa 10.5%.

Question 1

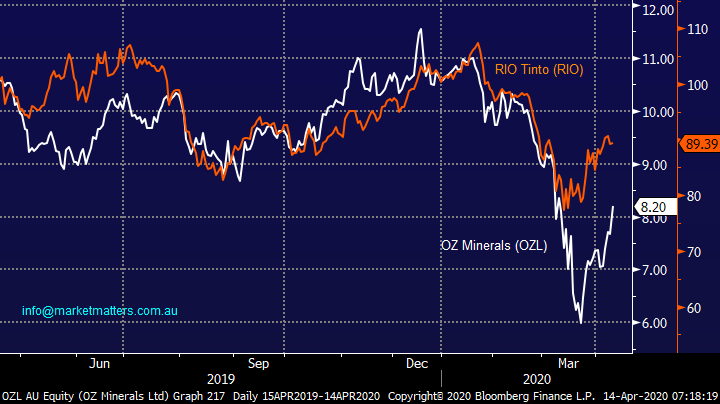

“Hi James and the Team, Much appreciation for your email again. I hope the weather in Sydney has been as good as it has been in North Queensland over Easter. Can I clarify that I understand the statement below correctly. You wrote: “However within the sector there is one “elastic band” which MM believes is becoming too stretched, we believe copper will catch up to iron ore in the months ahead leading to outperformance by the large producers like OZ Minerals (OZL).” I understand that to be that you expect Oz Minerals to rally strongly on the back of a rebound in the price of copper. Therefore, you’re looking to increase your exposure to Oz Minerals and other companies in the copper industry, and reduce your exposure to those heavily involved in iron ore. How’d I go? Hope you all have a great week, Alan P.

Morning Alan,

Sydney did turn on the weather for us this Easter, we’re lucky to live in this great country. You’re correct, In effect I’m saying we think miners with a copper bias will outperform those more heavily exposed to iron ore i.e. OZ Minerals (OZL) should close the performance gap on RIO Tinto (RIO) illustrated below. Especially useful for subscribers looking to enter the resources sector as the dust slowly settles in risk markets.

MM currently prefers OZL over RIO.

RIO Tinto (RIO) v OZ Minerals (OZL) Chart

Question 2

“I’m interested in Aus. government bond investing apart from XARO. I believe yields may go negative. Any thoughts / advice?” - Regards Mike C.

Morning Mike,

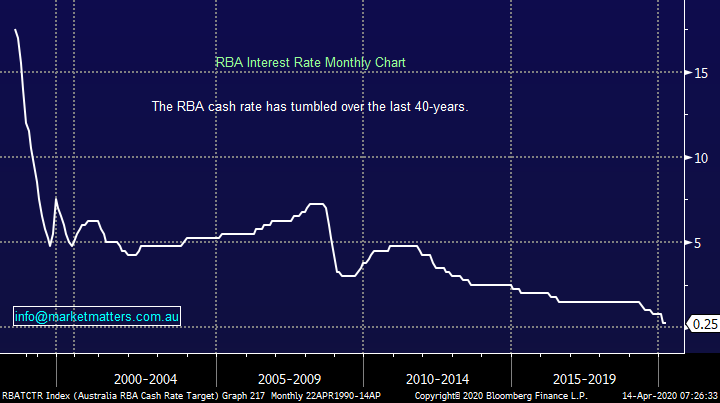

Personally I think interest official interest rates at 0.25% is basically as good as it gets for borrowers although I can see mortgage rates dipping below 2%, I feel this would be a cracker of an long term opportunity for housing affordability. However I wouldn’t be surprised to see the RBA cash rate bounce around between 0.0 and 0.5% for a few years, COVID-19 will have left a painful footprint on our economy that’s likely to take a while to work through.

However if we do believe we can see negative bond yields / interest rates in Australia an excellent vehicle to buy is the iShares Core Composite Bond ETF (IAF) shown in the second chart below – this is a $1.1bn ETF for anybody whose concerned around liquidity. Alternatively, we do hold Government Bonds directly for clients that are mandated to hold them, and we use the NAB Direct Bond Service.

Australian RBA Cash Rate Chart

iShares Core Composite Bond ETF (IAF) Chart

Question 3

“Hi James and the team, I have just read your update “Income Note: How far will banks cut their dividends? (ANZ, CBA, NAB, WBC)". As a self-funded retiree who manages their own super fund, I must say the update is well timed. Like most in my position our fund is heavily into the banks for the obvious reason, dividends. So with all of the uninformed press comments about suspension of dividends, it was good to read your comments. Time will tell how accurate they are but coming from someone in whom I have a fair amount of trust, the update was well received. Remember that not all of your clients a A-type persons looking for a slab of “alpha”. Some are trying to remain independent earning a living off that which they have accumulated. Updates on income are well received. In these times I hope the whole team stays safe.” - Regards Keith M.

Hi Keith,

Thanks Keith your thoughts and feedback very much appreciated. Unfortunately in today’s interest rate and economic environment it is indeed a challenge to live off fixed income and dividend yield but hopefully we are currently witnessing the nadir on this front. Unfortunately given the provisions that Westpac have taken this morning, it could well mean that they do not pay an interim dividend at all.

MM still likes banks if we see new lows.

Westpac Bank (WBC) Chart

Question 4

“Hi James, Love your work. My concern is about APRA. On about 18th March they "ordered" the banks to increase lending and reduce their capital ratios or buffers. Today, 8th April, they "order" the banks to reduce dividends and "consult" with them before making any dividend announcements. Why are they increasing funding to business by reducing capital ratios when only last year the banks had to issue shares to meet their higher demands. Now they want to cut the income of self-funded retirees. We get no help from the various relief packages. Do they have any idea of banking. If APRA want us to disappear, just let the virus do it for them.” – Graham A.

Hi Graham,

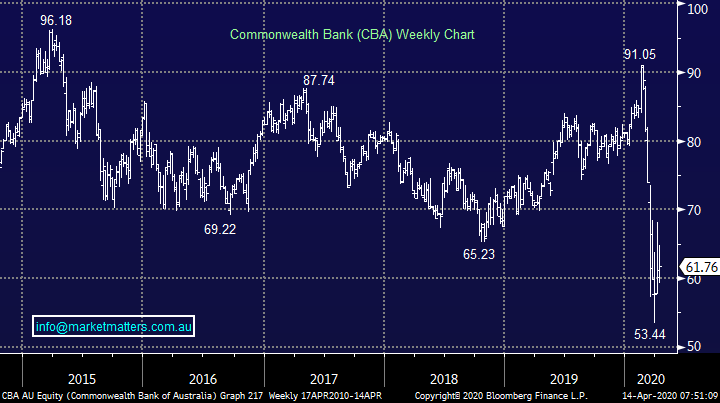

I sympathise and feel for you in a major way, a number of our clients are in a significant situation which is demonstrated by the previous question. Unfortunately I do feel the government are more focused on the people at work during this current crisis as they plan how to kick start the economy which is currently ticking over at best. However it’s a tough and frustrating time for many people on different levels, to end on a positive note which is always my preference I still believe CBA will outperform term deposits from a yield perspective.

MM believes CBA will continue yield above term deposits.

Commonwealth Bank (CBA) Chart

Question 5

“Hi Team, interested to know why you haven't recommend FMG as a buy over the last few months.” - Thanks, David J.

Morning David,

Unfortunately the answers simple, we were too pedantic on price! During the panic in March we had FMG firmly in our sights between $7.50 and $8, as the chart below shows it proved wishful thinking. We are already long BHP and RIO which influenced our caution with respect to increasing exposure to iron ore at higher levels but you never know it’s a volatile stock which might still provide a good entry opportunity.

MM likes FMG as a business but we are not looking to increase our iron ore exposure.

Fortescue Metals (FMG) Chart

Question 6

“Hi James What companies are ripe for capital raising? Can you give us a top 10 list?” - Kind regards Tim R.

Hi Tim,

A few successful capital raisings have led to rapid appreciation in stock prices in the short-term with Cochlear (COH) a great example, last week it closed 35% above its $880m capital raise price. However some have been less fortunate, it mainly comes down to why a company’s raising money. We’ve already seen placements from the likes of Webjet (WEB), Oomedia (OML) and NextDC (NXT), our thoughts and best guesses at future prospects are as follows:

Financials : Banks are unlikely to raise large amounts of equity like they did in the GFC. Challenger Group Financial (CGF), QBE are standouts.

Materials : Resource stocks are in good shape generally

Property: Scentre Group (SCG) raised already when they didn’t really need to. Unibail Rudamco (URW), Cromwell (CMW) , Vicinity Centres (VCX), GPT Group (GPT) & Mirvac (MGR) are all possible

Healthcare : Cochlear (COH) has raised already, Healius (HLS) and Ramsay Healthcare (RHC) the two most likely.

Infrastructure : Sydney Airports (SYD), APA Group (APA) and Transurban (TCL) in that order.

Others : AP Eagers (APE), Bapcor (BAP), Boral (BLD), Brickworks (BKW), Collins Foods (CKF), Qube Logistics (QUB), Seek (SEK) and Seven Group (SVW).

Undoubtedly a long list but in todays uncertain economic environment we believe many companies would understandably be happier with more cash on the balance sheet, I know I would!

Cochlear (COH) Chart

Overnight Market Matters Wrap

- The US equity markets started their week on a negative tone ahead of its earnings season

- Crude oil fell despite record OPEC production cuts that was agreed and finalised, while the safe haven Gold gained.

- This week in the US, first quarter earnings will be mainly seen via the financials with JPMorgan, Bank of America, BlackRock, Goldman Sachs and Wells Fargo reporting.

- On the macroeconomic front this week, Canada’s rate decision, US retail sales as well as China GDP numbers are due.

- The June SPI Futures is indicating the ASX 200 to open higher this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.