Afternoon Report Tuesday 19 August 2014

The ASX 200 had a strong session today, closing 37 points higher as investors and traders looked to shift into “riskier” assets.

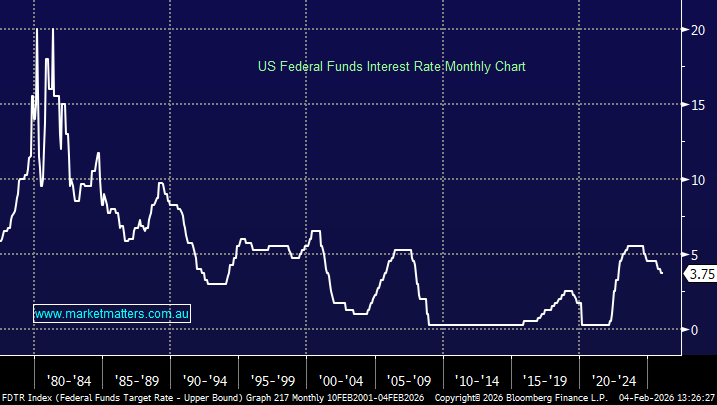

Today’s rally seemed to have been due to the RBA minutes released, the market interpreted that the RBA may look to cut rates this year, with previous expectations leaning towards a rise. The following points led to the RBA pointing towards a rate cut:

The Australian Dollar trading higher than its forecast.

Commonwealth Bank (CBA) performed well today as expected, down $1.41 at $79.99 despite trading ex-dividend at $2.18 a share. We remain long-term holders of this stock at present.

Bank of Queensland (BOQ) was the clear standout today in the bank sector, closing 32c higher at $12.29. We would be happy for current shareholders staying long here.

Show more...