Market Matters Afternoon Report Monday 15th August 2016

Good Afternoon everyone

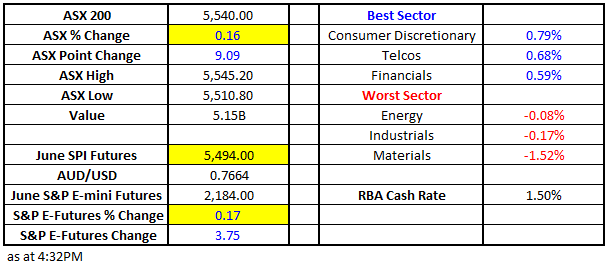

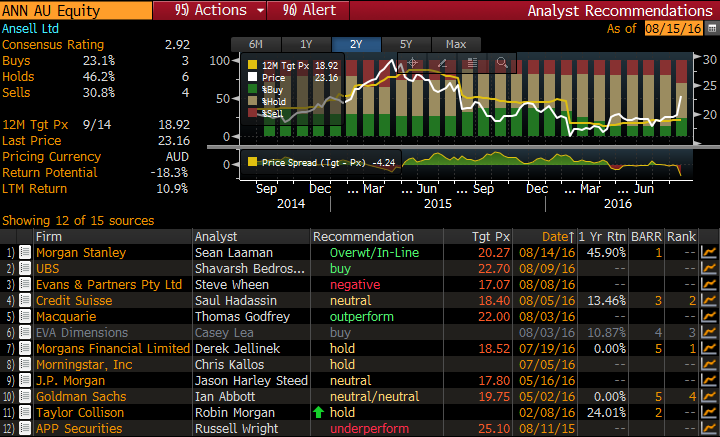

Market Data

What Mattered Today

You’d be forgiven if you thought it was a fairly mundane session for the ASX with the index bouncing around a pretty tight range however the banks offset weakness in the miners, stocks that reported well surged while those that didn’t….didn’t!

A range of +/- 35 points, a high of 5545, a low of 5510 and a close of 5540, up +9 points or +0.16.

ASX 200 Intra-Day Chart

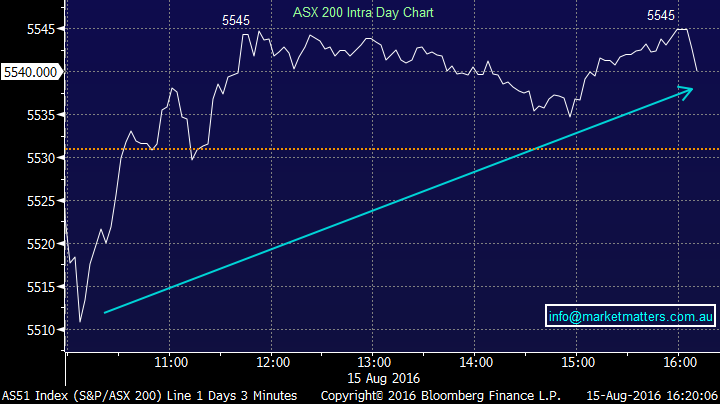

Ansell (ANN) led the mkt higher storming up by +17.74% - again, another stock that delivered ‘less bad’ numbers, the market was negative on – had been building up on the short side then bang…shorts cover in a reasonably illiquid stock and we see a very strong move to the upside.

Ansell (ANN) Daily Chart

Consensus, was weak an ANN and most were expecting a fairly soft result. The result in itself was a beat to expectations – which in fairness were low, however the market seemed to get most excited about restructuring talk, particularly the spin-off of the sexual wellness business (condoms) after they hired Goldman Sachs to start the process.

Shorts have been building here….up to 6.19% from just 1% in September 2015. Brokers on the whole have been negative with the consensus price target sitting at $18.92 – about -18% below today’s closing price. These numbers will be revised tomorrow however it highlights why such a big pop…

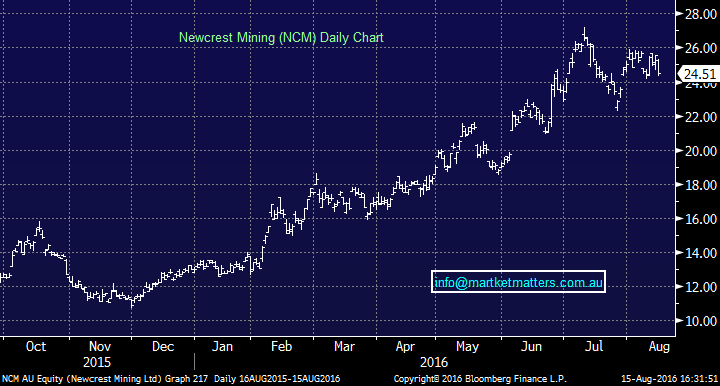

Newcrest (NCM) was also out with numbers today and it was slight miss on some of the major metrics however they beat on the ones that really matter. For instance, revenue was 1% below consensus, EBITDA was a 2% miss, EPS was a 2% miss, dividend of 7.5c was a 25% beat however at that level we’re talking semantics (and they shouldn’t have declared one anyway given current debt levels) while probably the biggest element that mkt was focussing on – gearing – was better with net debt of $US2.107bn v the mkt at $US2.189bn.

Free cash flow was a massive beat coming in at $858m vs $658m consensus. At current spot gold price, NCM would be generating an additional >$300m pa FCF than the $858m in FY16 – NCM now has clear options; (i) (further) Deleveraging, (ii) capital management and (iii) growth – capex and exploration. Dividend reinstated.

A result that shows good progress – even though it seemed the mkt was caught up today on some of the elements that were a tad light on. We like NCM but at lower levels…

Newcrest (NCM) Daily Chart

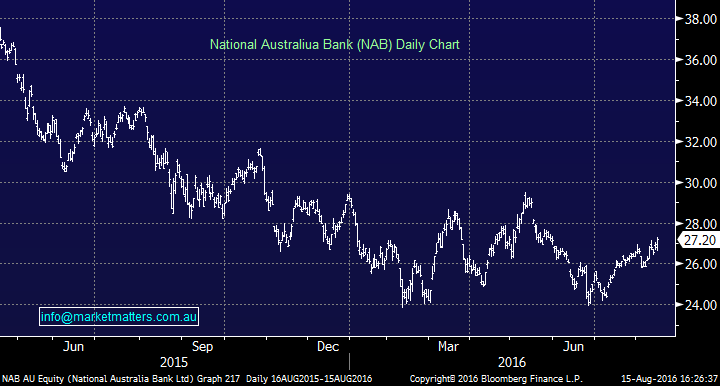

National Australia Bank (NAB) had a quarterly trading update and although these don’t have a lot of detail in them, they provide a reasonable look at trends for the bank. NAB was OK with cash profit of $1.6bn (2% less than some thought), bad debts $228m (inline) , margins lower (which was pretty well flagged), revenue flat, costs down 1%, Common Equity Tier 1 at 9.5%.

So looks a little light on however not by much. The capital was OK and NAB is the cheapest of the big 4 trading on 11.6 times – so the result was enough to push the stock up +0.93% to $27.20.

National Australia Bank (NAB) Daily Chart

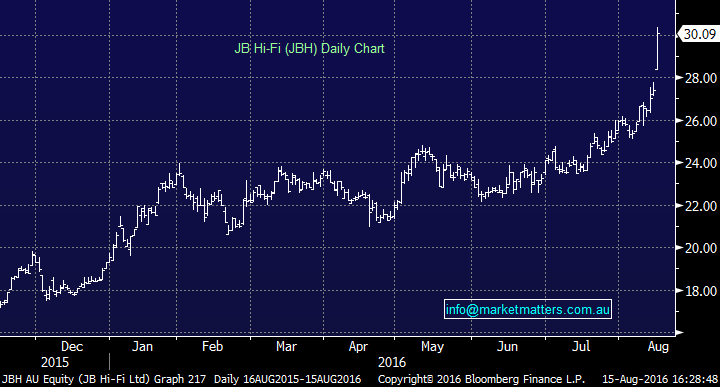

JB Hi-Fi (JBH) continued to be bid up today with the stock hitting another all-time high of $30.09 – up 9.90%. The coy beat market expectations on most metrics and smashed their own company guidance benefitting from the wind up of Dick Smith + the ACCC approval for the potential acquisition of the Good Guys….A hard result to fault really and the stock continues with its impressive run….

Total Sales +8.3% to $3.95bn

Comparable Sales up +5.4%

Gross profit up +8.4%

EBIT up 10.1% to $221.2m

NPAT up +11.5% to $152.2m

EPS up +11.5% to 153.8cps

….an exceptional result.

JB Hi-Fi (JBH) Daily Chart

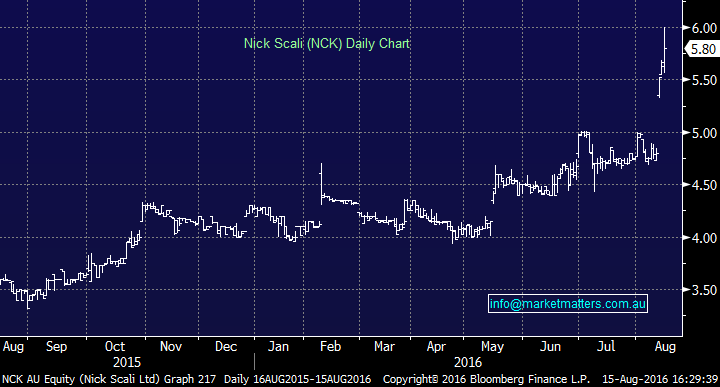

Nick Scali (NCK) is another quality – if not smaller retailer – that gave a great set of numbers on Friday showing that bricks and mortar retailing – if done well can still be very rewarding. They reported profit up +53% on the prior period and the stock is now benefitting from higher liquidity after the sell down from the Scali family. A stock we’ve covered before in the MM morning reports…

Nick Scali (NCK) Daily Chart

On the flip side, Aurizon (AZJ) was soft today with the freight operator missing mkt expectations on their full Year result + guidance was below market expectations. On FY17 numbers consensus was for EBIT of $975m – they’ve guided to $900m-$950m so at the midpoint of that ($925m) it’s about a 5.1% miss. The stock was -6% today.

Aurizon (AZJ) Daily Chart

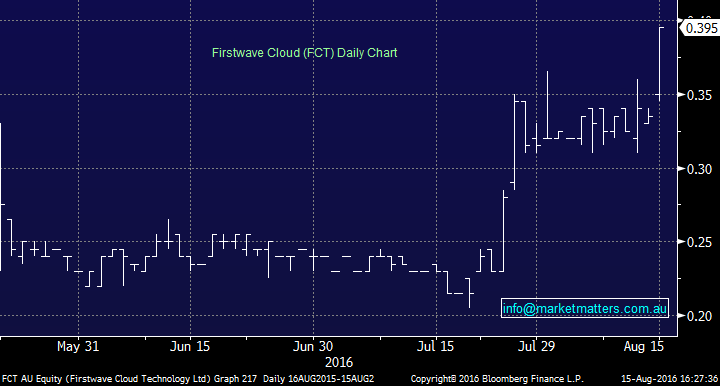

…and finally a smaller company for all those inclined that looks very interesting. We saw the management from FirstWave Cloud Technology (FCT) last week - it’s a company on focused on security solutions for cloud based applications and they have an existing deal in place with Telstra (TLS) to piggy back off their sales/distribution channels. Sellers dried up today and the stock popped +17% to close at 39.5c. A very interesting story indeed!!

FirstWave Cloud Technology (FCT) Daily Chart

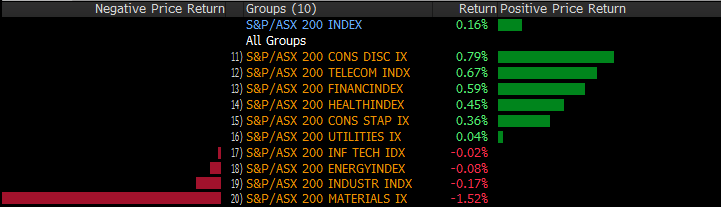

Sectors

Source; Bloomberg

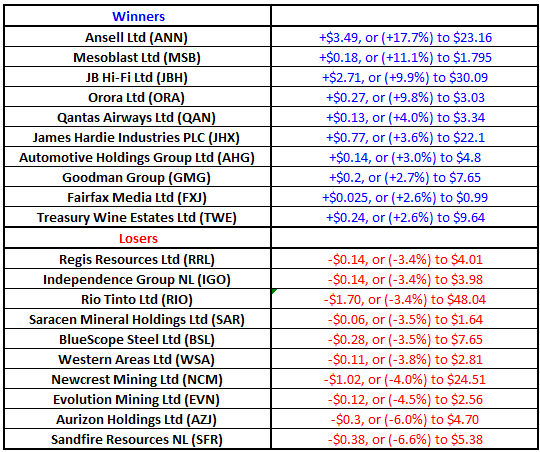

ASX 200 Movers

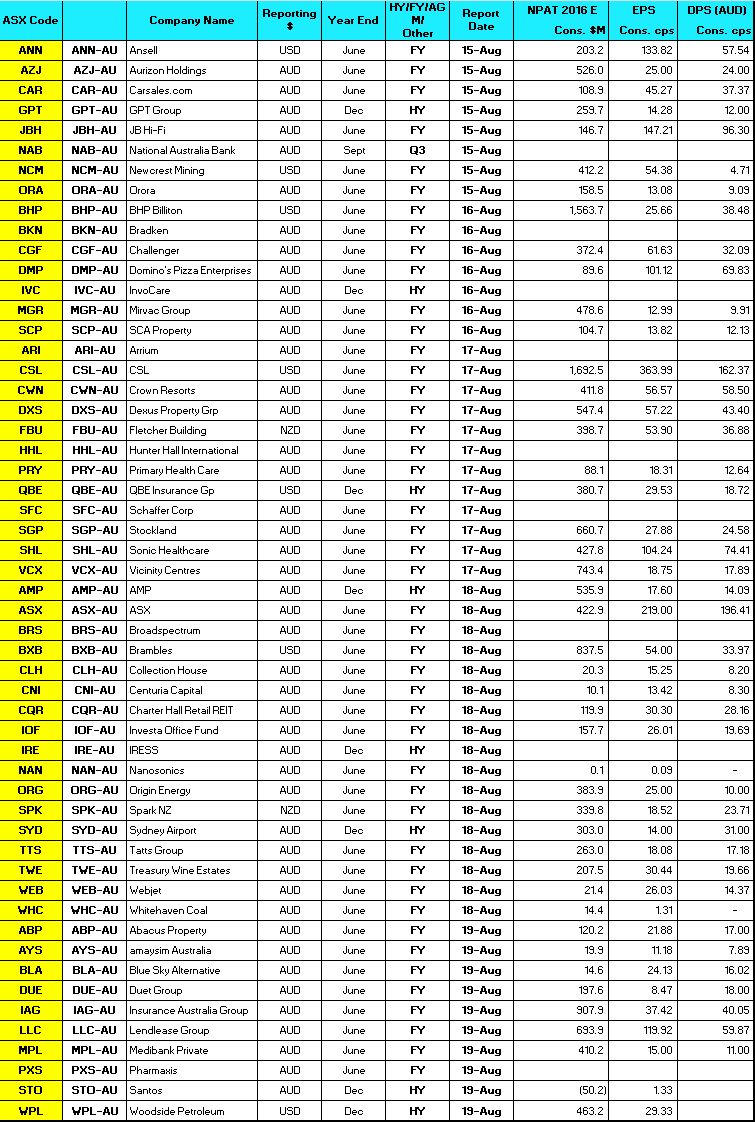

Reporting this week

NPAT = net profit after tax (consensus numbers)

EPS = earnings per share (consensus numbers)

DPS = dividend per share (consensus numbers)

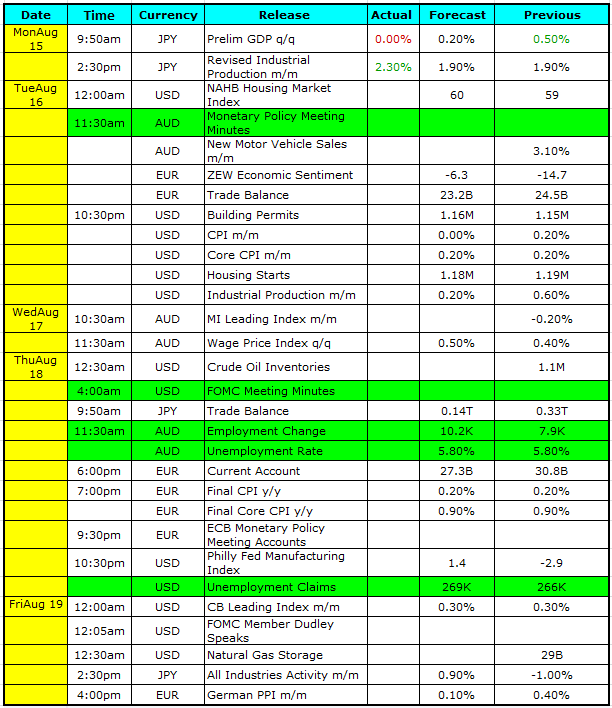

Select Economic Data – Today & Tomorrow; Stuff that really Matters in Green

What Matters Overseas

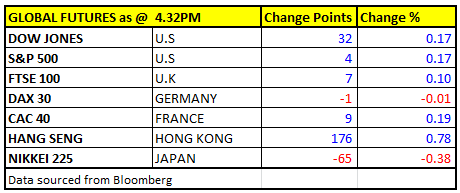

FUTURES pointing to a reasonable start…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/08/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here