Market Matters Afternoon Report Monday 22nd August 2016

Good Afternoon everyone

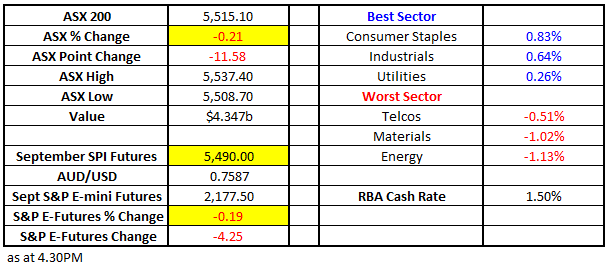

Market Data

What Mattered Today

A choppy session dictated by corporate earnings given no real economic data to speak of. That’s the theme this week with Fed Chair Janet Yellen speaking in Jackson Hole on Saturday morning our time the only major market moving economic event.

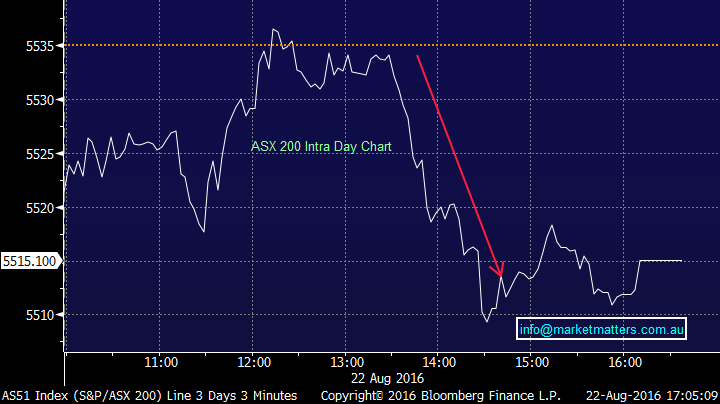

Anyway, on the market today we had a range of +/- 29 points, a high of 5537, a low of 5508 and a close of 5515, down -11 points or -0.21%. We’ve had a very tight trading range for the last 11 consecutive days – just 71 points which is extremely rare.

ASX 200 Intra Day Chart

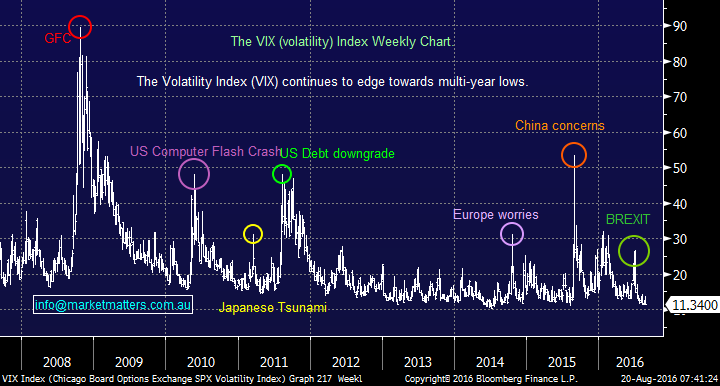

It sort of feels a bit like a duck moving effortlessly along a tranquil pond – all looks peaceful from above but there’s a lot going on beneath the surface. Let’s hope a hungry croc isn’t lurking nearby as complacency remains high. Complacency and miss-pricing of risk makes us nervous and if we look at the volatility index in the US, we can clearly see this theme playing out. A low VIX means options premiums are relatively low - cheap if you’re a buyer of options but the opposite is obviously true if you’re a seller.

Volatility Index / VIX Weekly Chart

In terms of results today, GWA Holdings (GWA) was a cracker – well above market expectations from an earnings perspective while the dividend was 8c (v 7c expected) plus they paid a special dividend of 1c which the market loved.

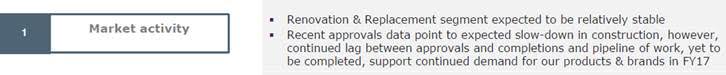

For those not familiar with the company, they sell building fixtures from two divisions – one that does bathrooms and kitchens – the other does door and access systems. The stock was up +18% on the day however their view of the current housing market is interesting – and reprinted below. Clearly, we are in the mature stages of the current housing boom - the Special Dividend tells you that!

GWA Group (GWA) Daily Chart

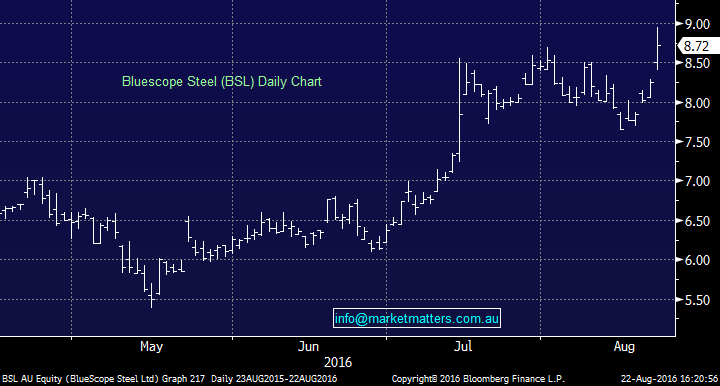

Bluescope (BSL) was also positive today after they reported full year numbers that were a shade below consensus on an underlying basis however guidance for FY17 was strong. They printed $293m underlying which was a tad weak however underlying EBIT guidance for 1H17 of at least +50% on 2H16 was good, and implies EBIT of $510m – which would be a strong result. The dividend was 6c for the full year,inline with expectations. BSL closed up +5.7% to $8.72

Bluescope Steel (BSL) Daily Chart

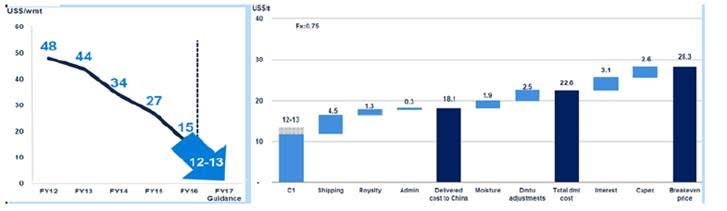

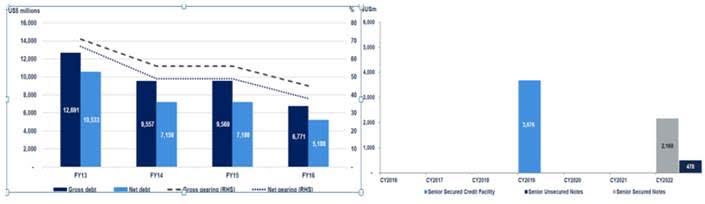

Fortescue Metals (FMG) was another good result – however, much of it was known from their recent quarterly production / trading update. The stock ran extremely hard into this result – up from $1.50 in January to a morning high of $5.05 today.

Good earnings – a BIG beat on market expectations – better dividend – more debt reduction – good cost control so why was the stock down? It’s now all priced in and then some with the stock now trading at 1x price to book.

Here’s a quick look at FMG’s cost profile – take a bow Nev Power!

…and importantly their debt profile

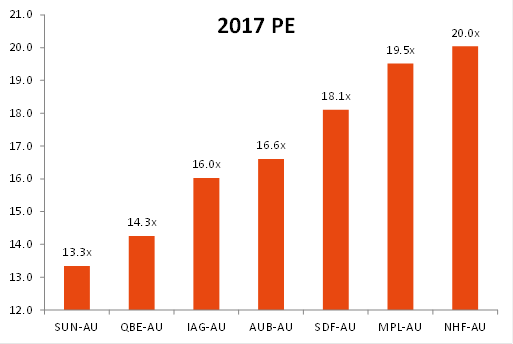

NIB Holdings (NHF) followed Medibank (MPL) down the chute today (-7.5% to $4.44) and again it was all about their outlook. We saw a better result from NIB (than MPL last week) with actual policy holder growth in Australia 3.8% vs -2.5% for MPL but it’s hard to justify such a high multiple for stocks with such a tough operating environment.

Source; Shaw and Partners Research

NIB Holdings (NHF) Daily Chart

We had a question from a subscriber around the outlook for Ramsay Healthcare (RHC) and gave the following response which seems topical this afternoon…

Ramsay Healthcare (RHC) $74.92 - After reassessing RHC this morning, we are now cautious the stock and would run stops under $73. In the bigger picture, we do eventually see the stock back under $60. The main variable for RHC (and other hospital operators) stems from pricing pressure coming from the health insurers. Medibank reported last week (and was hit hard on weak guidance) while NIB has just dropped with their results (and reported a relatively good number), however, policyholder growth is the weakest in a decade at ~1%, and participation rates are falling as affordability issues become more evident. Participation rates across the industry have fallen around 0.5% - which makes life tough for the insurers and will in turn put pricing pressure on the healthcare providers like RHC.

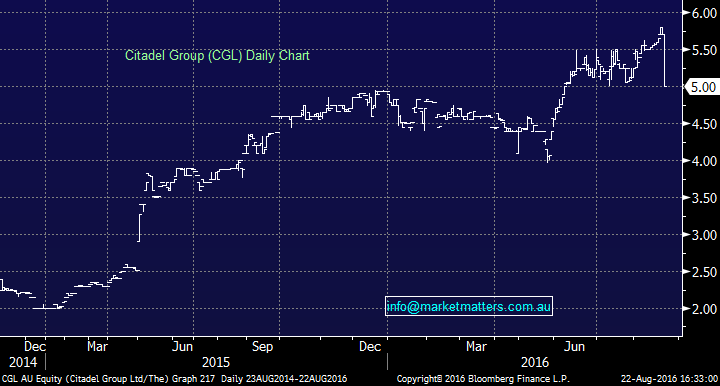

Citadel Group (CGL) – a smallish tech stock we wrote about some months ago when the stock was trading around $5.00 reported today – and shares dropped -12% to close back at $5.00. It had been as high as $5.80 on Friday… First and foremost, it’s a stock that trades by appointment, with a massive spread between bid and offer – so this amplifies any market moves.

The result was obviously weaker than expected with top line revenue coming in at $85.1m v expectations for $91.8m – still up 18% on the year but a miss all the same. Much of it was a result of the poor performance in their education business, which is being hit by lower student numbers – a theme we’re seeing across many of the education providers.

All up, if investing in a company at this stage of its life, management is key – and CGLhave a great team. It’s a low capex business with sustainably high margins - has net cash on a clean balance sheet - long tenure contracts with blue chip paying clients, an increasing recurring revenue stream and clear competitive advantages to peers. A soft result but positive outlook remains unchanged.

Citadel Group (CGL) Daily Chart

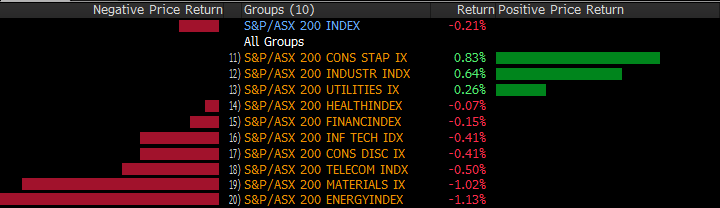

Sectors

Source; Bloomberg

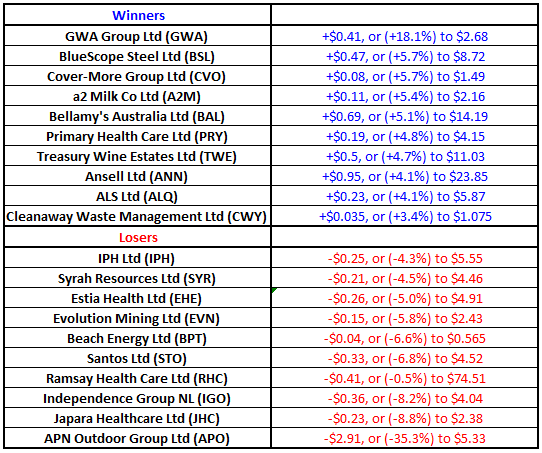

ASX 200 Movers

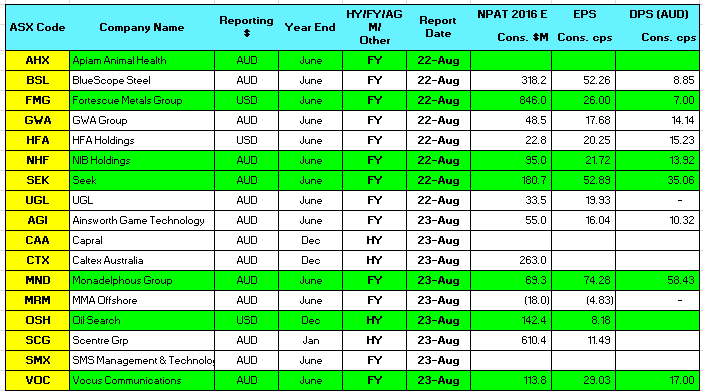

Reporting; Today and Tomorrow

NPAT = net profit after tax (consensus numbers)

EPS = earnings per share (consensus numbers)

DPS = dividend per share (consensus numbers)

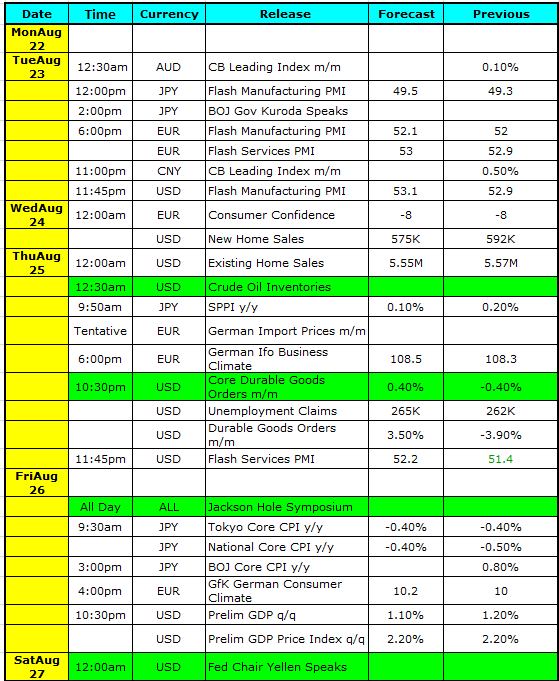

Select Economic Data – This week; Stuff that really Matters in Green

Not a lot to hang ones hat on this week with Janet Yellen’s speech in Jackson Hole on Friday evening their time of most significance. As it stands, there seems to be a BIG disconnect between what the Fed is saying and what the market is pricing. Fed members are priming the market for another hike in 2016 yet the market is only pricing this as a ~50% chance. We think those expectations are undercooked and this may be the catalyst to bring the market out of its complacent slumber.

What Matters Overseas

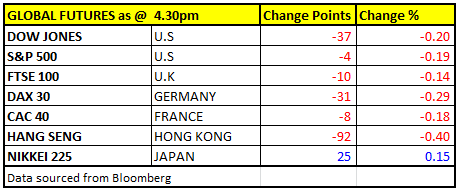

FUTURES pointing to a weaker start…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/08/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here